Compound interest is a concept you have to understand if you want to be rich.

The Great Pyramid of Giza, the Hanging Gardens of Babylon, the Statue of Zeus at Olympia, the Temple of Artemis at Ephesus, the Mausoleum at Halicarnassus, the Colossus of Rhodes, and the Lighthouse of Alexandria.

Those are known as the Seven Wonders of the Ancient World. Unfortunately, only one of them can still be visited today. Who thinks there’s an eighth wonder? Well, according to Albert Einstein:

“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” – Albert Einstein

What is compound interest

Compound interest is the interest you earn on the interest you previously earned. What? Here’s an easy example: You put $100 in a bank account that pays 1% interest. At the end of the year, you have $101. The next year, the account earns another 1%, but that’s not just a dollar anymore. That 1% now equals $1.01, so your account balance is now $102.01.

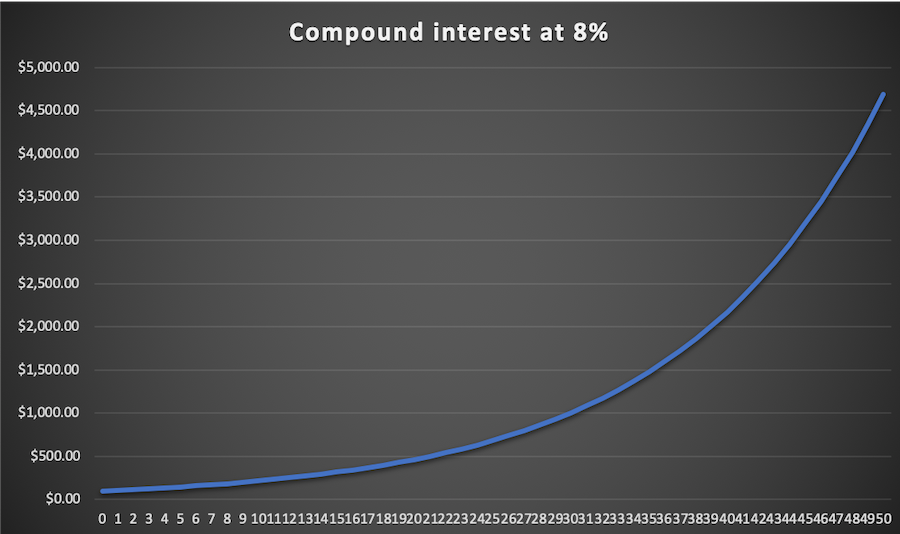

That extra amount, the extra penny, is compound interest. It was paid to you purely because of the interest you earned last year. Doesn’t seem like much, does it? No, not at 1% for 1 year. What about 8% for 40 years? That same $100 would turn into $2,172.45. At that point, the yearly interest you are earning is larger than your original investment (the account earned $160.92 in year 40). Now you can see why Einstein felt the way he did about compound interest. A decent interest rate combined with a long time horizon becomes very powerful indeed! Add a few zeroes to those numbers and you can start to see how this concept fits into your retirement plan.

Cool abstract theory, let’s see it in the real world

Einstein wasn’t alone, though. Warren Buffett owes his vast fortune to three things:

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” – Warren Buffett

Warren Buffett is worth somewhere north of $80 BILLION dollars, and he credits America (its capitalist structure allowed for the greatest economic growth in the world over the last hundred years), his genes (acknowledging that he’s blessed with above-average intelligence), and compound interest! He’s famous for his buy and hold investing strategy, which is exactly what you need to allow compound growth to do its magic.

At 43 years old, Buffett’s net worth was $34 million (yes, with an ‘m’). Something you and I would be proud to have, but not a figure you would look at and say, “that guy’s going to be a billionaire.”

Just a dozen years later, though, his net worth did pass $1 billion at age 55. And now here he is at age 88-ish, with $88-ish billion dollars of net worth. It took 55 years to get to the first billion, but then only 33 years to tack on another $87 billion. That is the prototype of compound interest.

Einstein and Buffett are geniuses, how does this affect a normal person?

A graph of Buffett’s net worth, the shape if it going up exponentially towards the end, is how it would look for any amount of money invested at a decent interest rate for a long period of time.

That’s the growth of your $100 dollars from earlier. It hits $2,172 at year 40 and $4,690 at year 50. That’s right, it more than doubles in those last ten years. The key is to give compound interest enough time to work. That means putting money away at an early age because the first 20 years or so is a slow grind before it goes parabolic.

I know, it’s not very realistic for a 20-year-old to plunk down $100,000 at one time, never invest anything else again, and retire at age 70 with $4,690,000. That’s just a simplistic example of how powerful compound interest is.

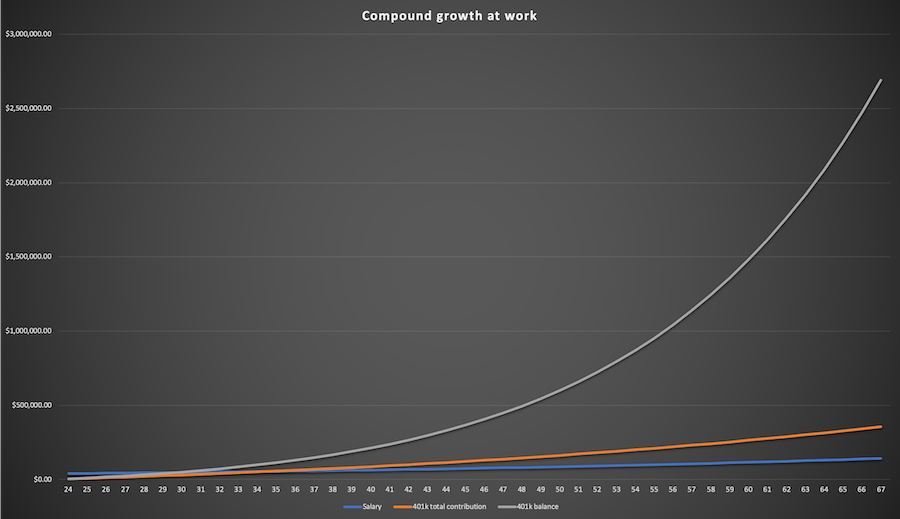

Here’s a more realistic example… a recent college grad starts working at age 24. His starting salary is $40,000 and increases 3% each year. He saves 10% of his salary each year with a 3% company match, and earns 8% each year on the investments. He retires at age 67. That’s the scenario, and it seems pretty normal to me. No crazy salary or savings numbers. He doesn’t even max out his 401k in any year! The main factor is that he’s consistent for a long time period.

Our example’s final salary ends up being $142,580.67. His total contribution to his 401k was $356,193.64, or a little more than $8,000 a year on average. His 401k balance grew to $2,691,990.02. For those keeping score at home, the vast majority of the account balance is compound interest.

In retirement, he can then withdraw 5% of his 401k account each year ($134,599.50) and actually have more money to spend than when he was working (final salary of $142,580.67 – 401k contribution of $14,258.07 = $128,322.60). The tax treatment is the same for both amounts, so after taxes, he’ll have about $6,000 more to spend each year in retirement than he had while he was working. That’s a beautiful, simple, realistic plan that lets compound interest do the heavy lifting.

Oh, and his company match? His company ended up putting in over $100,000 on top of his contributions. He then earned compound interest on that free money. Do not miss out on your company’s match!

How can you take advantage of compound interest?

For a young person, it’s critical to get started investing now. The biggest hurdle for young people is figuring out how to save money. Here are C.S. Lewis’s thoughts on the matter…

“Good and evil both increase at compound interest. That’s why the little decisions we make every day are of infinite importance.” – C.S. Lewis

It’s easy to convert that quote into financial terms. Saving money leads to good compound interest. If you are paying credit card interest, that’s evil compound interest crushing your future. Every little financial decision you make each day compounds into a huge difference in your bank account years later. That’s why the ‘gurus’ are yelling at you for paying $5 on a daily frappuccino. So find a way to start saving money now, even if it’s just $50 a month. It all helps and it all gets compounded.

What if you are older and time isn’t on your side? Well, compound interest can still help you, but you won’t get the exponential tail at the end. You will have to make tougher decisions to save more and make more money in order to counteract the shorter time period. Depending on your age, maybe you have to save 20% instead of 10%. Maybe you need to push back your retirement date by a couple of years. Maybe you need to alter your big expenses (house, car, food) in order to permanently lower what your 401k balance has to support during retirement.

What if you’ve gone through everything and you still can’t hit the savings rate you need? Don’t lose hope, you just probably need to read up on some of my other investment techniques. One of which will allow for a 7% withdrawal rate.

That wraps up our little lesson on the most powerful force in the universe (another Einstein quote, he really was smitten with compound interest). Please start taking advantage of this concept by investing now and accelerate your journey to financial freedom!