Speed up your retirement date without having to increase your savings rate.

First, some history on retirement

People retiring at some point in their life is a fairly recent concept. Prior to the 1700s, the average life expectancy was only 40 years old at the high end. The focus was to have children who were capable of tending the farm before you passed away. “Enjoying your golden years” was not even a thought.

It wasn’t until the mid-to-late 1800s that people started living long enough where they could out-live their job requirements. It was mostly physically demanding jobs that would’ve been tough to do past 50 (firefighters, policemen). The government recognized that weakness in the system and developed pension plans to help those workers. As life expectancy increased, even people with desk jobs were reaching a point where health started affecting their job performance. A few corporations followed the government’s lead and offered pensions to their employees.

That takes us into the 1900s before retirement was a widespread concept that most people would actually plan for. And that initial planning was more for when they had to stop working, not when they chose to stop. Social security was initially developed to take care of those who lived exceptionally long enough to make work impossible. The average life expectancy in 1935 was 58 for men and 62 for women, but the retirement age was 65! You weren’t expected to collect social security even if you reached life expectancy. Up until the mid-1900s there still wasn’t much planning to do: you had a company pension plan. Your pension basically told how much you would receive during retirement. You had no control over the investments.

Financial planning is in its infancy

That brings us to modern times. Retirement age is still 66 or 67 based on when you were born, but life expectancies are up to 76 (men) and 81 (women). There’s now a 10-15 year gap where you expect to not work and enjoy retirement. More importantly, pensions have fallen out of favor and put the individual in charge of their own retirement planning.

Here’s what I mean by financial planning still being in its infancy: the instruments put into law to replace pensions have only occurred over the last 45 years. Individual retirement accounts (IRAs) were developed in 1974. Employer 401k plans started in 1978. Roth IRAs came to be in 1997! Over the span of humanity, 45 years is nothing. Another way to look at it: current retirees are the first ones who have retired under this new system where the individual is responsible for their own retirement. We only have one generation of data, and that generation hasn’t even finished their retirement yet!

Just like everything else in our current digital world, though, ideas about retirement are advancing exponentially. Working your entire life was replaced by retiring at 65. Now that is being challenged by people trying to retire at 45 or even 30 years old. Attempting something that few people have tried in previous generations naturally leads to making conservative assumptions to make sure it works. Trying to get your nest egg to support you for 50 years takes an entirely different level of planning than having your money last for only 10 or 15 years.

Without historical data, these pioneers have to rely on theory. A popular theory now is the 4% safe withdrawal rate. It’s grounded in data and makes logical sense. But… what if you could have a 7% safe withdrawal rate? How would that change your planning?

What difference does your withdrawal rate make?

Up until this point, you’ve probably never heard anyone talk about 7% withdrawal rates as sustainable so please humor me for a moment; suspend your disbelief and let’s walk through an example.

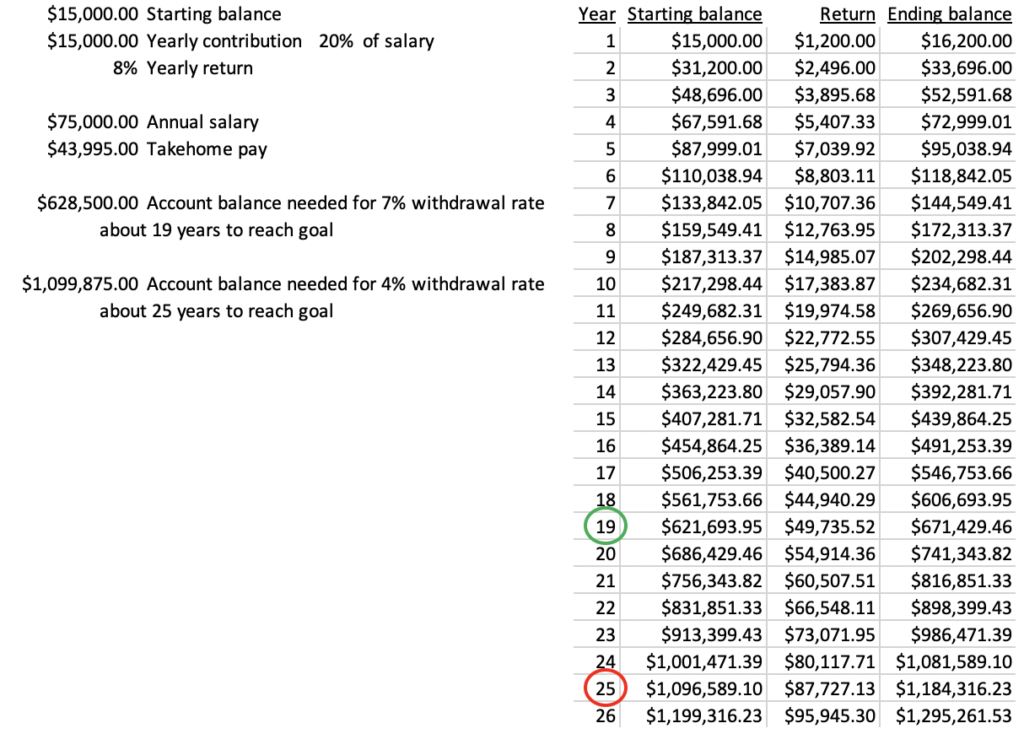

In this example, you are making $75,000 per year. You contribute 20% of your salary ($15,000) each year to an investment plan. Your take-home pay after deductions and taxes is $43,995. We’ll use that as the income you need each year of retirement since that’s what you’re used to living off of while working. For a 4% withdrawal rate, you’ll need a portfolio of $1,099,875 while a 7% withdrawal rate would only require a balance of $628,500. As the chart below shows, your balance will reach $628,500 in about 19 years. It will take another 6 years for your balance to get to the $1,099,875 needed for a 4% withdrawal rate. That’s an additional 31% longer to reach your retirement goal. That’s 6 years of freedom that no amount of money can buy back for you.

Ok, so you can see how much an increased withdrawal rate speeds up your retirement date. That’s without changing your spending. It’s without jacking up your savings. Your day-to-day life didn’t change. The only thing changing is your portfolio to allow for a higher withdrawal rate. Those higher yields will also help during any market downturns.

A diversified portfolio with a sustainable 7% yield

What does that kind of portfolio look like? What investments have income that high?

You might be thinking of individual stocks with sky-high dividends. No, you don’t want your portfolio full of Centurylink or other companies with an unsustainable dividend they will have to cut. The stock price gets dumped once that cut happens and your portfolio will be in serious trouble at that point.

Mutual funds and ETFs generally don’t have high enough dividends.

Individual bonds aren’t paying that much now unless you go emerging markets, right?

Real estate investment trusts, or REITs, are a possibility. You just need to do some homework on which are high quality, sustainable dividends and which will go the route of Centurylink.

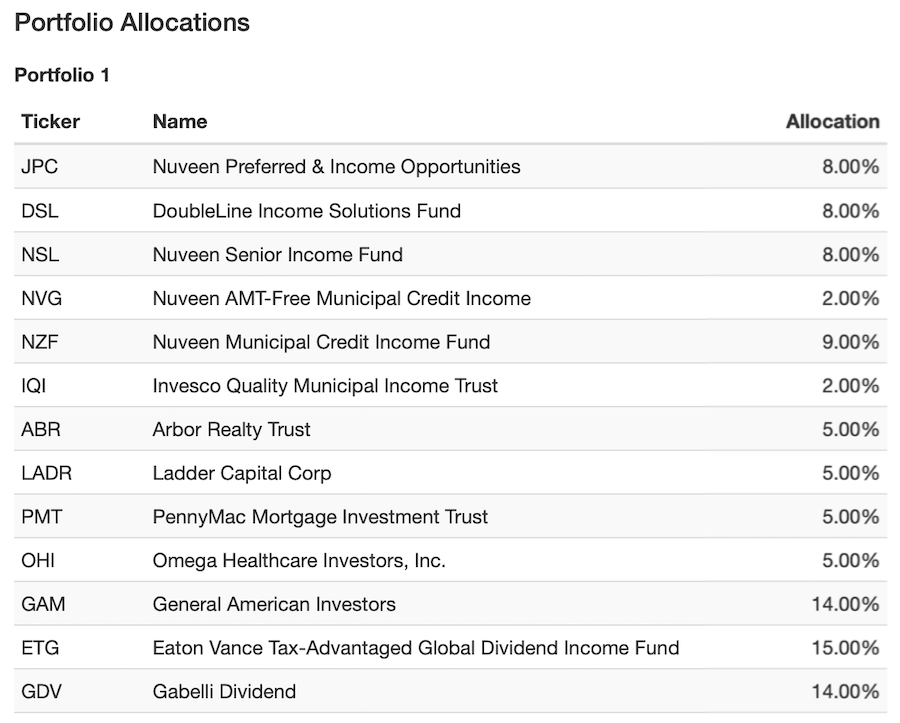

The main vehicle for this portfolio is something you probably haven’t heard of before: closed-end funds. Even though you might not have heard of them before doesn’t mean they are some brand-new, hyped-up investment that salespeople make huge commissions on. No, they’ve been around for a while, but they aren’t big enough for the large firms to trade in and out of.

Without further ado…

This portfolio holds domestic and international equities. It holds REITs in various sectors. It holds different types of fixed income: municipal bonds, world bonds, senior loans, and preferred stock. It’s more diversified than your typical mutual fund-holding portfolio. The breakdown is 37% fixed income, 20% real estate and 43% equities.

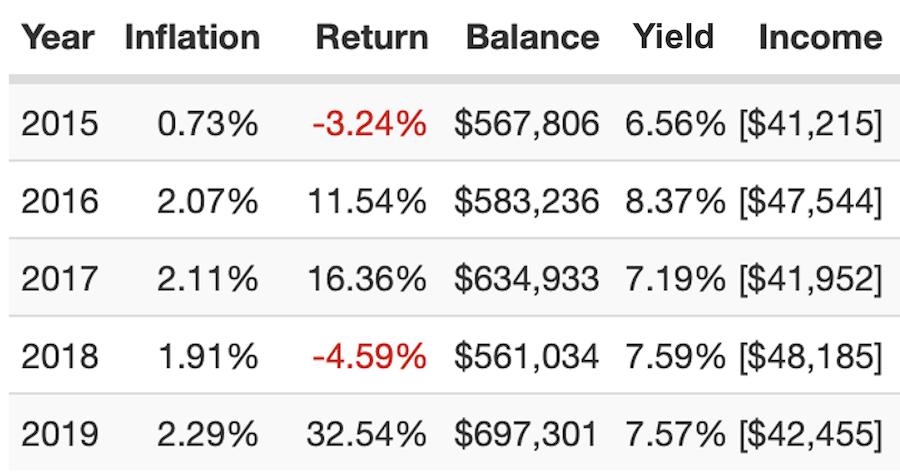

I promised a 7% yield that would cover your living expenses, right? The chart below shows what this portfolio yielded each year along with the income you collected. The annual income averages out to $44,270, which would cover the $43,995 you needed in our example.

Income is great and all, but how has the overall balance faired? Quite well. Even though you are taking out all income (around 7%) to pay for retirement, the account balance is still going up by a compound annual growth rate of over 2%. That will keep up with inflation and maintain your purchasing power over a long retirement.

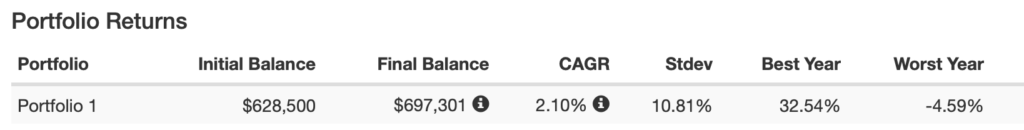

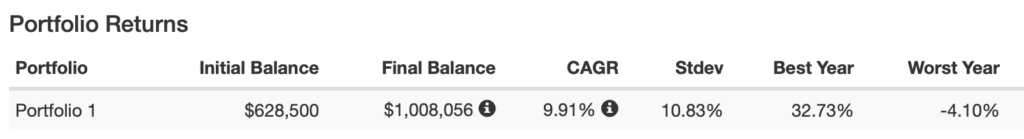

And here are the returns if you reinvested all of the income this portfolio is spitting out:

A compound annual growth rate of almost 10%! You were thinking this was supposed to be a conservative income portfolio? Nope, it would serve you well through the accumulation phase, too. You would just want to focus on which accounts hold each investment to limit taxes.

Final Thoughts

A portfolio yielding 7% that has also shown price appreciation is a beautiful thing. It’s more diversified than typical portfolios. The main difference is its use of closed-end funds. Closed-end funds are a huge advantage to the individual investor. CEFs don’t have to sell assets just because random investors are selling shares. They are a great wrapper for your investments as opposed to open-end funds, aka mutual funds, but there are some things you need to know about them to be an intelligent investor. I’m also not the only one who believes in closed-end funds that thinks a 7% yield is sustainable and realistic.

I hope this article opens up your eyes to some other possibilities besides what you read everywhere else. You can set up a more intelligent portfolio that allows for higher withdrawal rates. Most ‘experts’ telling you it’s not possible couldn’t explain closed-end funds to you. Thanks for reading and I hope it accelerates your journey to financial freedom!