A mix of basic index funds beats most active management

What is the 3 fund portfolio?

Everyone’s talking about a 3 fund portfolio, aka the lazy man’s portfolio, that actually beats professional money managers. Way back in the day a man named John Bogle started a company called Vanguard. His entire premise was that it’s extremely difficult to beat the market consistently year after year, so why not just try to match it? He created index mutual funds for that simple purpose: match the market, don’t try to beat the market.

Obviously, he was on to something because now passive index funds are extremely popular. A group of investors emerged calling themselves Bogleheads, as in followers of what John Bogle was preaching. They wanted to keep their investments simple, low-cost, and diversified. Eventually, they discovered a formula that checked all three boxes and just… worked. And here it is:

Step 1: invest in the following passive index funds.

42% VTSAX (Total stock market)

18% VTIAX (Total international stock market)

40% VBTLX (Total bond market)

Step 2: rebalance periodically.

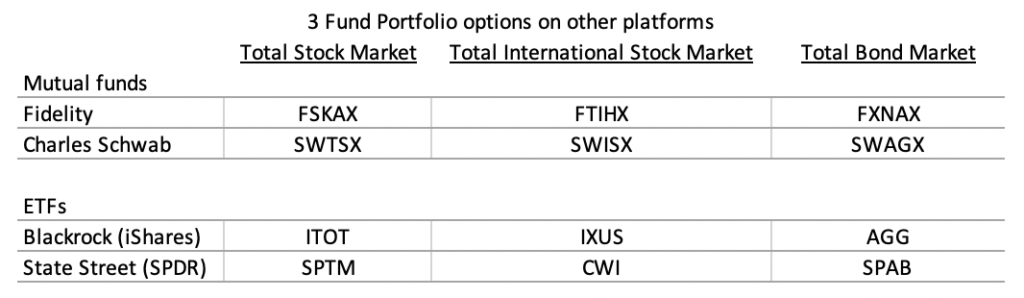

….and that’s it. That’s the formula and it has worked for millions of people. The Bogleheads formula can even work with many rival companies’ funds:

You can still make it work if you are stuck with just one company’s fund options for some reason.

Is that really all there is to it?

For the most part, yes. The one other big decision to make is your asset allocation; how much are you going to put into each of the 3 funds. I put the standard percentages up top, which leads to 60% stocks and 40% fixed income, with about a third of your stocks in international stocks.

I recommend 50% / 20% / 30% (that’s 50% Total Stock Market, 20% Total International Stock Market, and 30% Total Bond Market) since it gives the best risk-adjusted return over the long haul.

You can go 42% / 18% / 40% if you are conservative or 35% / 15% / 50% if you are scared! Never go below that, though.

Once you choose your asset allocation, you’re ready to rock.

Why does the 3 Fund Portfolio succeed?

1. It allows index funds to do their job. The worst any individual stock can do is -100%, but there’s no cap on the upside. +3,000% is possible and has happened for many companies. The index lets all of the companies do their thing, letting market caps do the ‘rebalancing’ where companies doing great will take up more space and companies not doing well have their spot in the index shrink.

2. It takes market timing out of the equation and individual investors are terrible market timers.

3. It’s simple, so it takes any analysis paralysis out of the equation.

4. It doesn’t take much time. You don’t need to evaluate any investments or put a lot of thought into rebalancing. Just match up the percentages to 50-20-30, or whatever you chose, each year.

5. Having a basic 3 fund plan is far better than not having a plan (and therefore never getting started) or following a more complicated plan that you don’t actually understand. If you don’t know the strengths and weaknesses of your plan you could get hurt badly as economic and market characteristics change; you won’t know how to react.

6. By not having to spend much time thinking about it, it saves you from looking at it every day (which then leads to second-guessing and market timing)

7. The equity indexes are tax-efficient.

Are there any downsides I need to be aware of?

1. You’ll end up ignoring some asset classes: real estate, small caps, world bonds (foreign bonds only make up 3% of VBTLX), and other forms of fixed income like preferred stock or floating rate loans.

2. Market cap weighting allows for concentrations in just a few companies (MSFT, AAPL & AMZN currently account for 10% of VTSAX).

3. The 3 fund portfolio usually has a low yield (currently 2.34%) which hurts retirement planning. You need a higher yield to avoid selling a large number of shares during downturns. It’s not a big deal when you are in the accumulation phase, but makes a big difference during retirement when you are pulling money out each year.

Wrapping up

Any faults in the 3 fund portfolio are soundly outdone by the positives. This strategy is easy enough for anyone to get started without analysis paralysis. You don’t have to evaluate investment options or pour through financial statements. It’s easy to keep up with so you can look at it no more than quarterly.

If you haven’t started investing yet, get started now using the 3 fund portfolio. You can alter it later as you gain investment knowledge, but for now, just get started! If you’re already invested but don’t understand your investments or have too many investments to keep up with, think about replacing your current plan with the 3 fund portfolio. Simplifying your investments could bring you peace of mind.

You could also keep it simple and earn 1% more a year.