Some investments are better in certain accounts because of different tax structures. Here’s how to align those tax structures to minimize taxes.

To maximize your financial independence goals, you need to increase income, minimize expenses, maximize investment gains, and minimize the taxes paid on those gains. This article will tackle that last item.

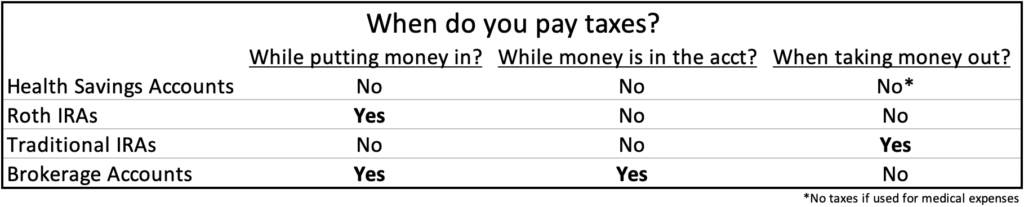

I group different account types together based on their tax structure. With that mindset, we have:

What types of accounts are there?

What does each account type mean and when should you use each account type?

Health Savings Accounts are one-of-a-kind and should be maxed out if a high deductible health insurance plan fits into your family’s needs. It is the only account type where it’s possible to not pay any taxes on the money. Ever!

The Roth IRA category includes Roth 401K’s as well. I believe we are in a low tax environment right now so these accounts should be maxed out. Go ahead and pay low taxes now in order to pay no taxes ever again on this money. It’s also the very best account to leave to your heirs; 100% tax-free to them.

The Traditional IRA category includes any other IRA besides a Roth (Traditional, SEP, SIMPLE). It also includes all qualified employer plans where the money went in before taxes (401k, 403b, profit sharing). 457 plans should be grouped here as well even though they aren’t considered qualified plans. As we get into high tax levels, these should be a priority over the Roth options.

Brokerage accounts should include anything that doesn’t have a special tax structure. Individual investment accounts, joint brokerage accounts, and trusts are all in this category. You can put in as much as you want each year and you can take money out whenever you want without penalties. You already paid taxes on the money before it went into this account. You’ll pay taxes on dividends/interest/realized capital gains each year. The good news is you don’t pay any taxes when withdrawing money.

“Martin, brokerage accounts sound terrible from a tax standpoint. Why would I use any of these?” Simple answer: all of the other accounts have contribution limits, so this is where any money above those limits would go. It’s the only choice to keep investing at high levels. Brokerage accounts are also preferred if you are really focused on the ‘RE’ in FIRE (Financial Independence, Retire Early) because you can access the money before normal retirement age.

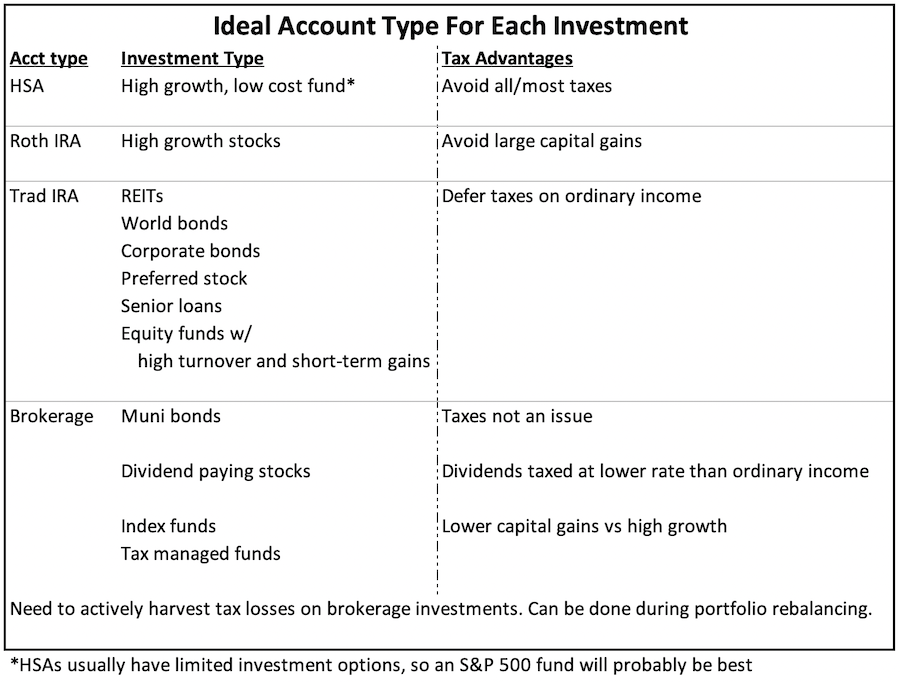

The best account to hold each investment

So now that you know how I’m defining the account groups, the following chart should be your guide to where each investment type should go:

Once you get each investment into its ideal account type, you are winning a huge part of the battle. The final stage is when it really pays off, though, and that’s the withdrawal order.

The icing on the cake – the ideal withdrawal order

This is the ideal withdrawal order to minimize taxes and maximize how long your money will last:

- First, you have access to any income from your brokerage accounts (tax-free interest & qualified dividends). You’re paying taxes on this income whether it stays in the account or not, so it makes sense to use this source first.

- Next, take a disbursement from your Traditional IRA accounts. Pay ordinary income tax on this disbursement while you are in low tax brackets.

- Third, you’ll go back to your brokerage account and take a disbursement from sold securities. You’ll pay long-term capital gains on whatever you sell to raise the funds needed for the disbursement but LTCG taxes are much lower than ordinary income taxes once you reach high tax brackets. You can also minimize these taxes by selling securities that have a loss or minimal gains.

- Fourth, you can take a disbursement from your HSA account. This is tax-free if used towards medical expenses. You can also track unreimbursed medical expenses over the years to avoid any taxes on this disbursement. You pay ordinary income tax after age 65 if the money isn’t used for medical expenses. Just make sure you and your spouse use up the funds before dying; the taxes on inherited HSA funds can be ugly for beneficiaries.

- Lastly, you can take a Roth IRA disbursement. This should be your last resort because it has the best tax deferral with no RMDs, and it is the best account for your beneficiaries to inherit 100% tax-free.

That basic outline will have you withdrawing money in an efficient manner. Here are some other tips to truly min-max:

- You can increase your Traditional IRA disbursements in your 60’s if RMDs at 72 will put you in higher tax brackets. You can also convert part of your Traditional IRA to a Roth IRA each year of this strategy if the income isn’t needed right away.

- If you have a financial advisor*, make sure all of your management fees are taken out of your Traditional IRA. This way, you are paying your fee with pre-tax money, effectively avoiding taxes on your management fees.

*I know a big part of the FIRE movement is avoiding financial advisors and keeping expenses low. There are some good FA’s out there, though, that charge low fees and really do have your best interest in mind.