Remember that investing is taking ownership in a company. Let that drive your long-term strategy.

Every investor has a strategy. In general terms, you could be a ‘growth’ or ‘value’ investor. You could read a book by Joel Greenblatt and swear by his analysis and logic. Your neighbor over the hedge can probably tell you some secret formula for picking amazing stocks. You might not even think you have a strategy; in that case, your strategy is to randomly pick your investments.

Remember this one thing no matter what your strategy is – owning stock in a company is owning a tiny portion of that company. A lot of people lose sight of this since they focus on stock prices, momentum, technicals, fundamentals, ratios divided by other ratios, if the wind blows from the west on a Tuesday, you get the point. People start to get a little crazy when they think they found an edge over everyone else.

Make investing easier by thinking of it in this frame of mind: is this a company you would be proud to own? Do you think this company is going to be more valuable in the future? How much profit will this company give to you as a part-owner? Forget all of the other jargon being thrown around. If you can answer those 3 questions you have a good idea if you should invest in the company long-term.

Companies announcing their earnings every three months is a terrible idea. There’s a reason it’s done, for public disclosure, but it affects the way companies are run and how stocks are traded. If a CEO thinks his job is in jeopardy you better believe he’s going to make decisions for the company based on the next three months. A lot of times that will be at the detriment of the company’s long-term health.

On the opposite end of the spectrum, you have Amazon and Jeff Bezos. In Amazon’s latest earnings report, they literally tell shareholders to take a seat. In other words, your short-term profits are going to take a backseat to our long-term goals. Every company should operate this way but few do. So when a company says it publicly it becomes headline news!

Stock prices also make big swings up or down based on those quarterly earnings calls; if Apple misses the analyst earnings estimate by 2%, the stock price goes down 5%. That doesn’t even mean their earnings didn’t grow year over year. It just means they didn’t live up to analyst expectations. Did the company really do something overnight that it’s now worth billions of dollars less today? That’s crazy as far as I’m concerned but that’s how a lot of investors approach investing.

Here’s a better way: forget about the daily swings in prices. Don’t sell because of short-term price movements. If anything, purchase more if you think the market is over-reacting in a negative way. Think LONG-TERM. Where will the stock market as a whole be in 30 years? It’s going to be higher. The global population is continually expanding, so the global economy must expand with it. There would have to be an apocalypse-type of event for that relationship not to hold true. And in that case, you won’t be worried about your investment accounts!

I’ll wrap this up with Warren Buffett’s thoughts:

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

“If you don’t feel comfortable owning something for 10 years, then don’t own it for 10 minutes.”

Source

Would you invest in that company if the stock market was closed for ten years? The economy continues on, the company continues to operate, you continue to own shares in the company, but you can’t trade the shares. Would you want to own those shares ten years from now when the stock market re-opens?

Don’t get caught up in all the short-term noise of the market. Focus on quality companies over the long-term.

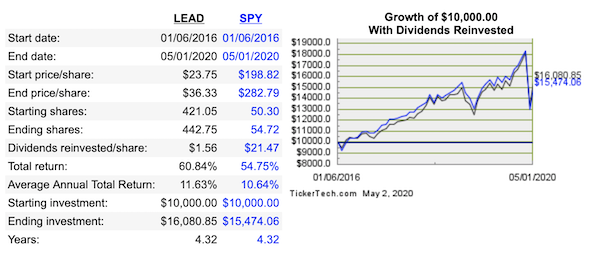

In case you were wondering, my magic investing formula is buying companies that consistently raise their dividends. This should lead to high-quality companies that I am proud to own for the long-term. To keep it simple, I gain access to them through ETFs like Vanguard Dividend Appreciation (VIG) and Reality Shares Divcon Leaders Dividend ETF (LEAD). Obviously, the Reality Shares fund is a lot smaller than Vanguard’s but their methodology is compelling. Using LEAD’s inception date of 1/6/2016, both have outperformed a standard S&P 500 fund: