Target-date funds may seem like a smart way to invest without having to think about it again but there are some serious drawbacks you should consider.

Do you know of any good results that come from being lazy? I can’t really think of a single one. Hard work will yield some results. Working smart will yield even better results. But being lazy has never led to results you can be proud of.

So why do advisors and financial “gurus” keep recommending target-date funds? They’re sub-optimal, and it’s very easy to get much better results. Do they really think that the average person trying to save is so stupid that they can’t pick three funds rather than one? A three-fund portfolio (link), while still not optimal, is far better.

Why are target-date funds terrible? Let me count the ways:

- You are paying double fees. You see a target-date fund is just a fund that decided to buy shares of other funds, packaging it together so the risk is appropriate for someone retiring at a certain date in the future, and then charges you a fee to invest in it. The problem is that each fund it invests in is also charging a fee. You could just pick the underlying funds and skip the target-date fund’s fees. Here are a couple of examples if you are planning on retiring in 2045:

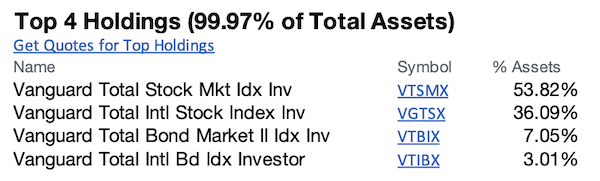

- Best case scenario: Vanguard VTIVX charges a very reasonable 0.15%, but it’s four underlying holdings also charge 0.14%, 0.17%, 0.09%, and 0.13%. That means you’re paying twice as much in fees as you first thought. Again, all of those fees are reasonable, but why not just buy the four holdings and skip the additional 0.15% the target-date fund is charging? Yahoo finance even shows exactly what percentage of each you should hold to match the fund: yahoo finance > type in the fund name or ticker > go to holdings and scroll to the bottom. This is what you’ll get:

Also keep in mind this is the best-case scenario with target-date funds; it gets much uglier…

- Expensive scenario: BlackRock LifePath Dynamic 2045 Fund Investor C Shares (LPHCX) charges 1.65% on top of its underlying funds, which charge anywhere from 0.15% up to 0.83%! This thing will make you broke before it helps you retire. Imagine if your 401k only offered this series of target-date funds and you listened to the ‘gurus’?

- The average target-date fund charges 0.73% on top of its underlying fund fees. I’d say that’s starting to get into the expensive category for anyone, and you still need to add the underlying funds’ fees to that.

- They are too conservative as you approach retirement. If you’re super conservative, a 50 stock-50 bond mix might be appropriate. I would never recommend going below that unless there are very specific circumstances for an individual that would require being more conservative. So how conservative do target-date funds get? Let’s take a look:

- Already in retirement: Vanguard 2015 VTXVX is 37% equity, 61% bonds. Too conservative. With only a 2.51% yield on all those bonds, you’ll struggle to keep up with inflation through retirement.

- Approaching retirement: Vanguard 2020 VTWNX is 51% equity, 48% bonds. This is the most conservative anyone should want to get.

- Accumulation phase: Vanguard 2045 VTIVX is 88% equity, 10% bonds. This mix is probably about right for someone mid-career.

- Just out of college: Vanguard 2065 VLXVX is 88% equity, 10% bonds. Too conservative. No reason for someone in their 20’s to hold bonds in a retirement account. What are you trying to protect?

- They do not make sense at all for someone attempting FIRE. You are trying to retire early, so what target-date do you choose? Let’s say I want to retire early at the age of 40 and choose the 2020 target-date fund. At its current allocation (which is only going to get more conservative), it has a yield of 2.23% and a five-year average return of only 5.99% (Vanguard 2020 VTWNX). If I need 4% of my portfolio to live off of for the rest of my life, I’ve basically resigned to never having a higher account balance*. It will barely keep up with inflation.

- Target-date funds are mutual funds so they’re going to have all of the same issues as regular mutual funds (tax inefficiency, cash drag, etc).

- If you hold the target-date fund in a taxable account, you lose any tax-loss harvesting opportunities when rebalancing. That’s because the fund is doing it rather than you buying and selling the underlying funds. Let’s say your target-date fund has a modest gain for the year, but one of it’s underlying funds is down big for the year. You have no chance of selling that underlying fund for the tax write-off. The only thing you could do is sell the target-date fund, which would lead to additional taxes since it’s up overall!

- You can even pay a flat fee, something like $300, to sit down with a certified financial planner and put a plan together for one hour. You still manage your own investments, and you’re not committing any more money other than the initial $300 fee. You’ll be able to follow that plan which will lead to lower fees every year going forward vs picking a target-date fund. For a $100,000 portfolio, $300 is a 0.30% fee, still far cheaper than target-date funds in a single year, let alone the multiple years of use you’ll get from the CFP’s plan. Those savings compound year after year just like your investment returns… not being lazy pays off!

Is there anything good about target-date funds?

The one positive target-date funds have going for them is their investors are much less likely to sell in a market panic. That’s a good thing because that’s when most investors make their biggest investing mistakes. The thing is, I don’t think that’s as much a function of the target-date funds themselves as it is just how freaking lazy target-date fund investors are.

If after all of this, I still can’t convince you to ditch target-date funds, then please pick the best target-date funds: Vanguard. It’s still going to suffer the same issues I mentioned above, but at least its fees are decent. It’s still going to be too conservative at retirement, and you’d still be better off getting bare minimum professional advice from a CFP.

Don’t be stupid and lazy. Be smart and just look lazy doing this instead:

So… are you still so lazy as to invest in target-date funds? Don’t accept the talking heads assuming you are dumb. Setting up your own investments can still be easy-mode!

Let me know your thoughts.

*Keep in mind the portfolios I recommend allow you to pull out 4-5% each year and the account balance will continue to grow by 2-3% each year. That means no matter how long your retirement is, you’ll A) never run out of money, and B) always have the same purchasing power.