How does inflation affect your financial plan? Inflation is something that’s easy to understand but your financial plan could fall apart before you realize if you don’t account for it. Don’t let inflation crush you!

Have you ever heard of the term purchasing power? It means you can buy the same basket of goods year after year even though inflation makes those goods more expensive over time. Your investment portfolio value must increase by the same amount as inflation to maintain your purchasing power. If you withdraw 5% each year and inflation is 2%, your portfolio should be returning around 7% each year to maintain your purchasing power.

Let’s take a look at Frank. He put together a financial plan and is looking to retire early. He expects a 4% withdrawal rate on a conservative portfolio that’s earning a 4% return. Should work out perfectly, right? He has $1,000,000 invested, it earns $40,000, he pulls out $40,000 to live off of, and he starts the next year with $1,000,000. Rinse, repeat. Right? Maybe, if there’s no inflation during his entire retirement. Frank knows there will be some inflation but doesn’t think it’ll affect him too much.

Even if you think there will only be 2% or 3% of inflation over time, you are still underestimating how much difference that will make in year 20, 30, or 40 of retirement. Why? Because it follows the same rules of compounding. The exact same reason people underestimate how much their investments will grow is the same reason inflation will crush your plans.

Back to Frank, but we’re going to factor in a 2.62% inflation rate (the historical average over the last 100 years).

Wow, Frank just got crushed by inflation. It’s a force like gravity. You can’t fight it. But you can only plan for it!

What went wrong? The first year, his investments earned $40,000 and he took out $40,000 to spend. In the second year, his investments still earned the same $40,000 but he had to withdraw $41,048 to maintain his same lifestyle (prices increased by 2.62%). In the third year, his investments only earned $39,958 (the same 4% return on the new basis of $998,952) but he had to withdraw an even larger $42,123 to buy all of the same stuff he bought in the second year. That gap gets wider and wider every year until finally the assets are exhausted.

You have to build purchasing power into your portfolio! This way, the income will increase every year so inflation doesn’t cramp your quality of life.

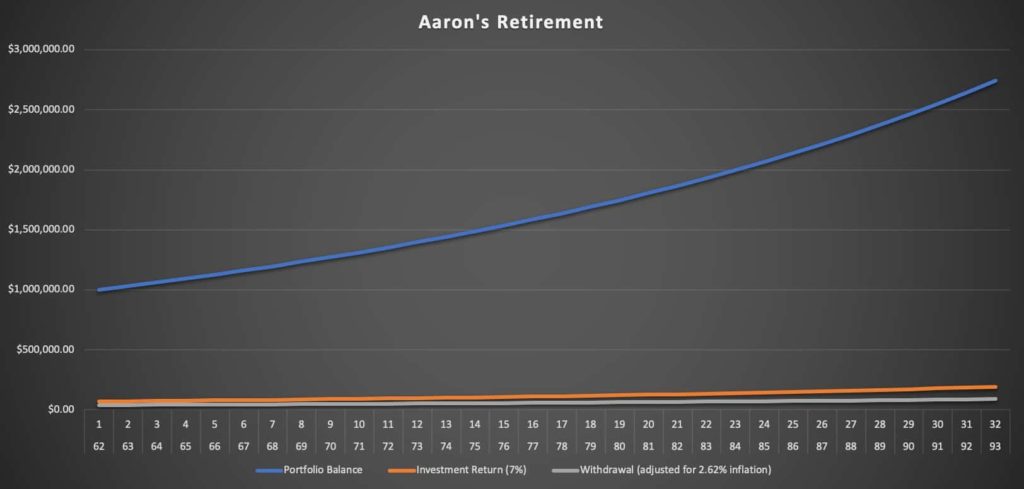

Now let’s check out Aaron. He has the same $1,000,000 saved up, he wants the same 4% withdrawal each year, but he stays invested 70% equity, 30% fixed income because he knows that has the best risk-adjusted return. His account returns 7% each year. Here’s his chart:

Aaron’s battling inflation and winning! Why is it so different from Frank’s? Because he allows the extra returns to stay in his account. His account earns 7%, and he withdraws 4%. The leftover 3% stays in the account, which means his future withdrawals will be 3% higher. Inflation went up 2.62%, but his account balance went up 3%. He is staying ahead of inflation, and that allows his account to maintain, even increase his purchasing power!

Seriously, those two charts look like a world of difference. The difference is 3%… accounting for inflation to keep your purchasing power. The psychological difference for a retiree is huge, though… it’s the difference between constant worry in the later years of retirement or actually enjoying yourself.

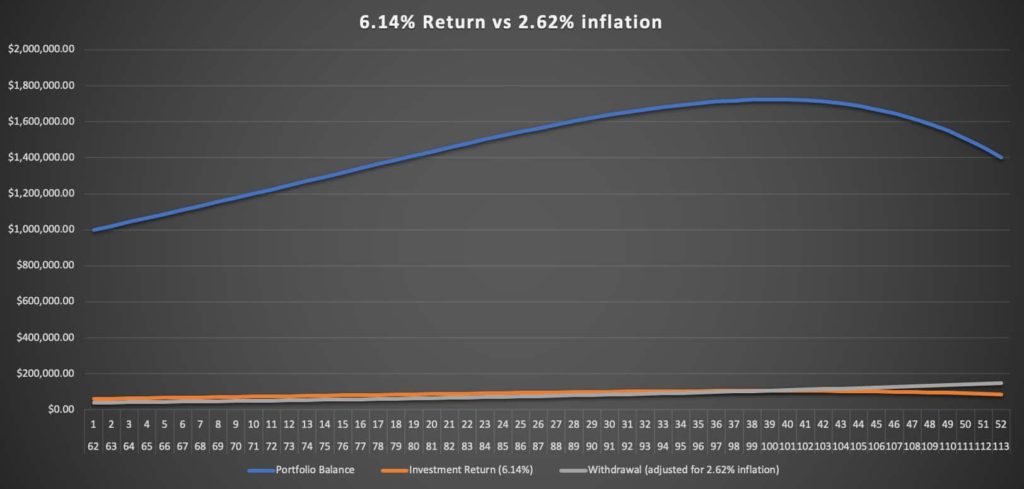

Don’t go too conservative in retirement. It’s fine to have a 4% withdrawal rate, but don’t have a 4% return rate as a goal. You have to shoot higher to make up for inflation. That doesn’t mean going crazy; just a 6.14% return would keep purchasing power until age 100 .

Oh, and that historical inflation rate pretty much matches the historical growth rate in home prices. Coincidence? I’m guessing not… but we’ll explore that thought in a separate article.