Buying a home has long been considered a smart move to build wealth but is it always the best use of your money or could renting be better?

Is buying a home really the best use of your money?

If you’ve ever bought life insurance, you’re probably aware the big decision is between whole and term policies. Whole life is much more expensive but you’ll be told there’s an investment portion to it that will grow and always be available no matter how long you live. Others will tell you to buy the cheaper term life policy and invest the difference in premiums in the stock market.

Buying a home versus renting a home is a very similar concept to the life insurance decision. You can either commit a large sum to a home and take part in its increased value over the years or you can rent a home with no down payment and invest the savings in the stock market.

In my view, buying term insurance and investing the difference is the smart thing to do but the home equation is more complex. How do you figure out which makes more sense for you? This is especially important in light of what to expect for future home values. First, let’s see how much owning a home will cost you long-term.

What is the total cost of owning a home?

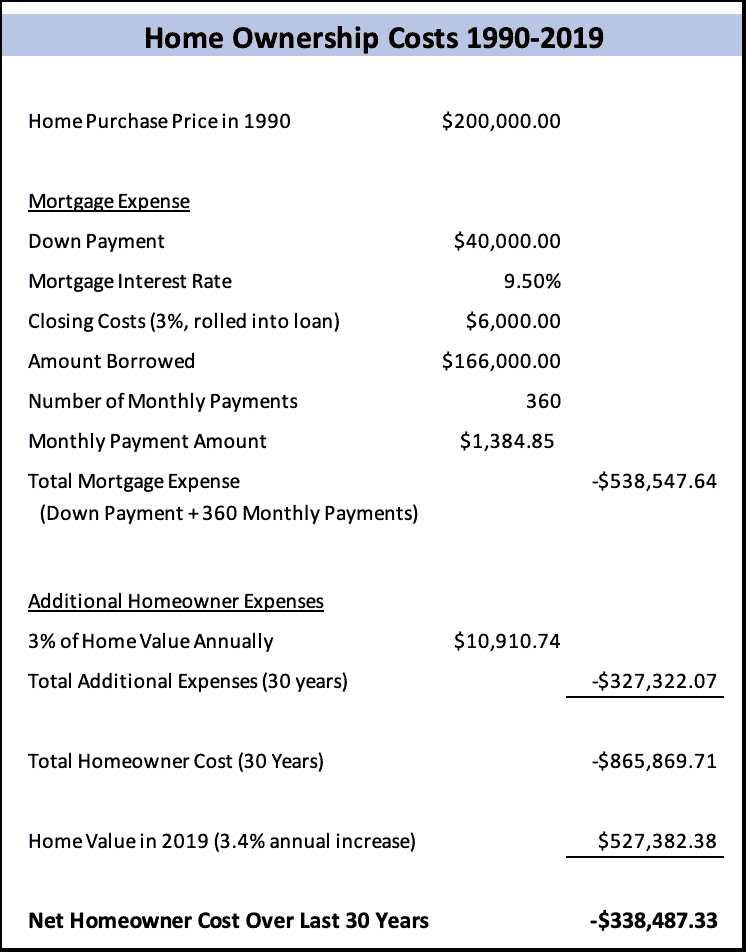

I’m going to look at a thirty-year period since most mortgages are for 30 years. I’m going to use data for the most recent 30 years, so we bought the home in 1990 and made the final mortgage payment in 2019. At this point, we know how much your home is currently worth (it’s current market value), but how much did it cost you over the thirty years?

The interest rate on a mortgage from 1990 would be about 9.5% and homes appreciated at 3.4% during that time period. I’m also going to use the generally accepted 3% rule: you will pay about 3% of your home’s value in additional expenses each year (1% for property taxes, 1% for repairs, and 1% for maintenance/miscellaneous items).

If you purchased a $200,000 home with 20% down, the mortgage would cost you $538,547 over those 30 years. The additional 3% expenses would total $327,322. That leaves you spending $865,869 over the thirty years in order to own the home outright.

The home price increased at 3.4% each year for the last thirty years and is now worth $527,382.

Wait, am I reading that right? You spent $338,000 more than the home is worth now? That doesn’t seem like a good investment. Let’s compare it to renting and investing.

What if you rented and invested the difference?

Costs of renting are straightforward compared to owning a home because you aren’t responsible for any ‘surprise’ expenses. Air conditioning unit goes down? Call the landlord. Your expenses are predictable as a renter; you pay rent each month. Of course, you have utilities, but you have those expenses when owning a home as well, so they cancel each other out.

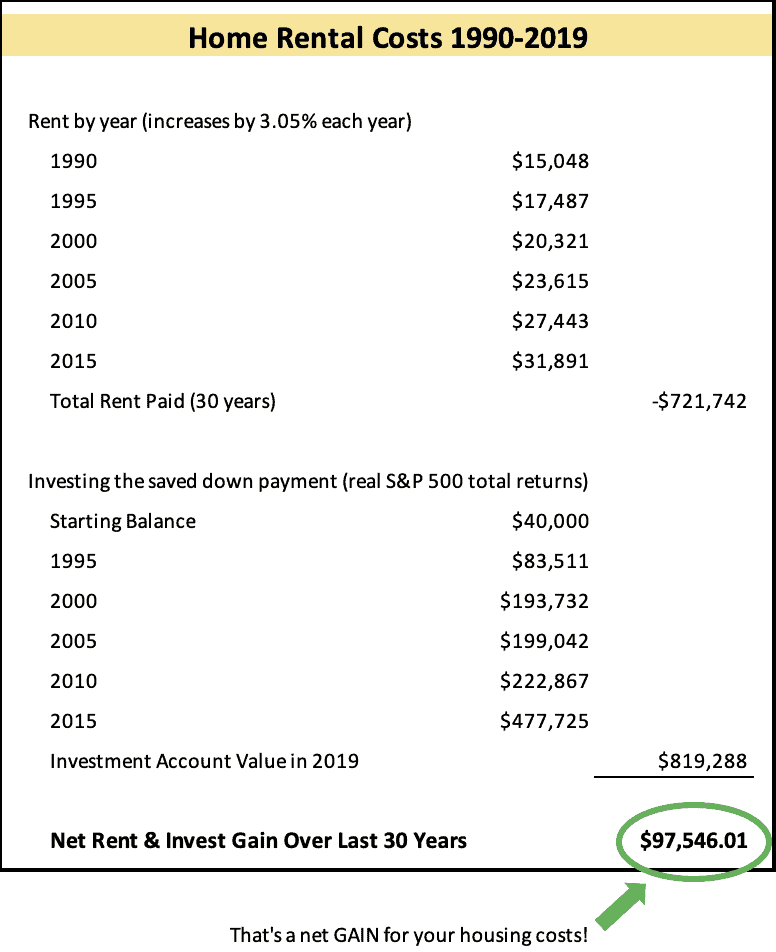

Assuming the same home, now worth $527,000, would rent for $3,000 a month, I used a discount factor of 3.05% to find that the home rented for $1,254 in 1990.

That gives us total rent over the thirty years of $721,741. That’s about $144,000 less than you would’ve spent as a homeowner but you don’t have the home as an asset. What do you have instead? You could have taken your initial down payment of $40,000 and invested it in the S&P 500. That $40,000 would have turned into $819,288 in 2019 based on actual S&P 500 yearly total returns.

Wait a minute! If you had rented from 1990 to 2019 rather than buy a home, you would’ve spent $144,000 less and your assets would be worth $290,000 more?! It seems like homebuyers were a bunch of suckers… perhaps. But these numbers are also very skewed. They include a high interest rate from 1990, and I imagine a homeowner would have refinanced to a lower rate at some point. It also includes a very good time to be invested in the S&P 500, with compound annual growth rates of 10% over those thirty years.

High mortgage rates and high stock returns from 1990 to 2019 put renting & investing way ahead of buying a home.

How does that analysis look today?

Running that analysis was eye-opening to me but how would the numbers look going forward with today’s rates?

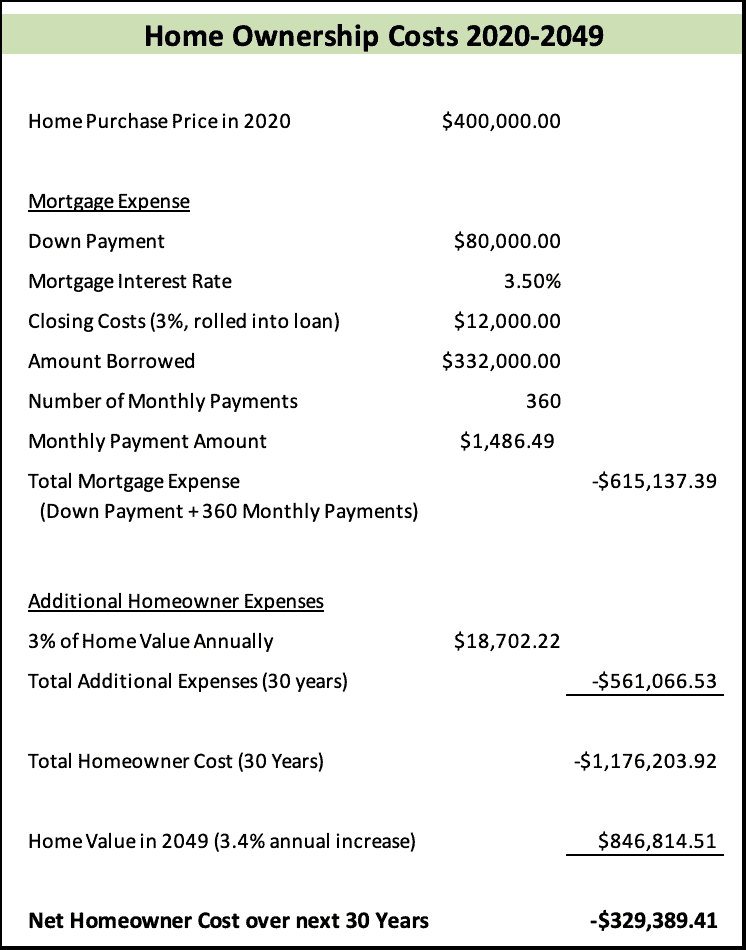

Let’s take a look at a similar example through the lens of today’s financials. That includes lower mortgage rates. I’ll use 3.5% for that. It will include slightly lower future home price growth. It will include slightly lower investment returns going forward. I’ll use 8% for the S&P 500 over the next thirty years.

If you buy a home for $400,000 with a 20% down payment your total costs would be $1,176,203 over the next thirty years. The home would appreciate at the rate of inflation (averaged 2.62% for the last 100 years) and be worth $846,814. Your net cost would be about $329,000 ($1,176,000 expenses minus the $846,000 asset).

Despite the adjustments we made, it didn’t affect the net cost of homeownership too much. The final net cost is very similar to the 1990-2019 conclusion: -$329,389 and -$338,487.

Renting over the next thirty years

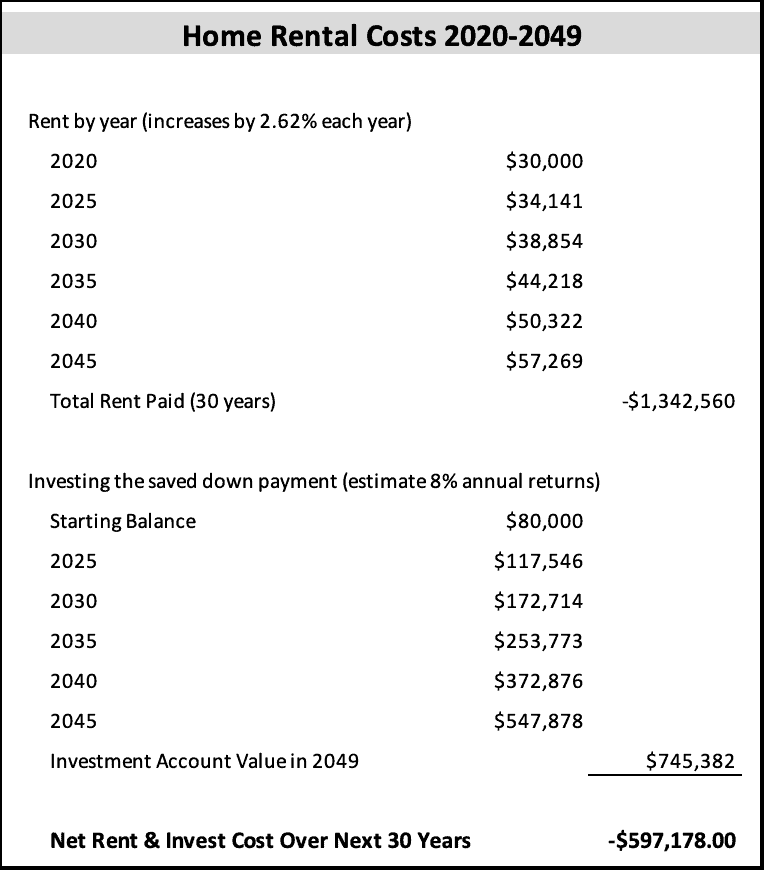

I estimate that same $400,000 would rent for $2,500 now. I also think rent will generally rise with inflation, so your rent will go up by 2.62% a year. Over thirty years, you will spend $1,342,560 on rent.

That’s a big change from the 1990-2019 example. You spent less on rent then, but now renting will end up costing $166,000 more than homeownership over the next thirty years. Maybe the investing portion can make up for it?

If you rented, you could take the $80,000 you saved for the down payment and invest it in the S&P 500. I have to use my crystal ball now since we’re looking into the future, and I will use 8% annual returns. That’s 2% less per year than the S&P 500 earned over the previous thirty years.

The $80,000 will become $745,382 in 2049, or about $100,000 less than the home will be worth. Combine that with the increased expense of renting and homebuying looks like the winning strategy for the next thirty years; your net worth will be ahead by about $266,000 versus renting.

I know I am making MAJOR assumptions in these examples and forecasts. They shouldn’t be used as the concrete, final authority in which strategy is better. Instead, use them to open your eyes to what’s possible. I’m actually very happy the results turned out so differently. It’s a great reminder that one strategy isn’t always optimal and you should run the numbers that are specific to your situation!

It’s a great reminder that one strategy isn’t always optimal and you should run the numbers that are specific to your situation!

What else can influence your decision?

Homeownership can act as a ‘forced savings account’. If you don’t have the willpower to save on your own, you can ‘invest’ in your home with each mortgage payment.

Homeownership can be frustrating when a string of unexpected expenses pop up and throw your budget seriously out of whack. You need to make sure your finances are on solid ground before making such a large commitment.

Renting gives you more financial flexibility. You’ll have more savings & investments since you didn’t make the big down payment. That can help if you lose your job. You can easily tap into those savings for the next few months until you are back on your feet. You could move into a less expensive rental much easier than you could switch homes! You could also move locations easier if a good job opportunity becomes available elsewhere.

Renting means you lose some control. You might not have a good landlord and have to move out within a year. Rent might increase more than you expect. If something breaks, it’s nice to not have to pay for it, but the person that is responsible might take their sweet time while you sweat it out with no AC. You also can’t make upgrades or renovations that will increase your enjoyment of the property.

Conclusion

Everything we’ve talked about here is for your primary residence. Investment properties are totally different since someone else is paying the mortgage for you and you have positive cash flow. Investment properties need to be put through an entirely different set of analysis to find a good deal.

For your primary residence, though, buying a home is a major commitment. Before jumping into it, make sure you run the numbers for yourself to see if it’s your best option. If you do decide to buy the next question you should ask yourself is “should I pay off my mortgage early?” Run the numbers and you’ll probably decide that paying off the mortgage early is not the best use of your money!