The ultimate ‘Sequence of Return’ stress test to start your retirement.

How did a high-yield, high-distribution retirement portfolio hold up during the pandemic, market meltdown, and economic shutdown of 2020? Despite naysayers saying a 7% withdrawal rate will never succeed, it just did during the ultimate stress-test.

A year ago, I wrote an article titled “EARLY RETIREMENT: YOU CAN RETIRE 31% EARLIER”. I then showed the math on how a 7% withdrawal rate would allow you to reach your financial independence number 31% faster than a typical 4% withdrawal rate. It was a shot across the bow of all the people claiming you had to withdraw less than 4% to be safe during a prolonged retirement. My argument: the source of the distributions is a major factor and they had left it out of their analysis. While most others will blindly say withdrawing 7% is doomed for failure, they fail to recognize that interest and dividends are more stable than price appreciation.

Well, the ultimate stress-test then played out right after the article was published – the stock market went down 35% and we had a complete economic shutdown. ‘Sequence of return’ risk could not have been higher!

So, if someone retired in February of 2020 with the portfolio I outlined, how would they have fared?

The cliff notes version – it looks like my thesis held up perfectly. The portfolio continued producing the same amount of income, even during the shutdown. The retiree used the income to pay his bills without selling anything at depressed prices. This allowed his portfolio to stay invested and fully recover.

Now let’s go into more details on some various aspects of the portfolio.

Income

We’ll first go over the income aspect of the portfolio because that is the most important thing to a retiree; maintain their ability to pay their monthly expenses throughout retirement.

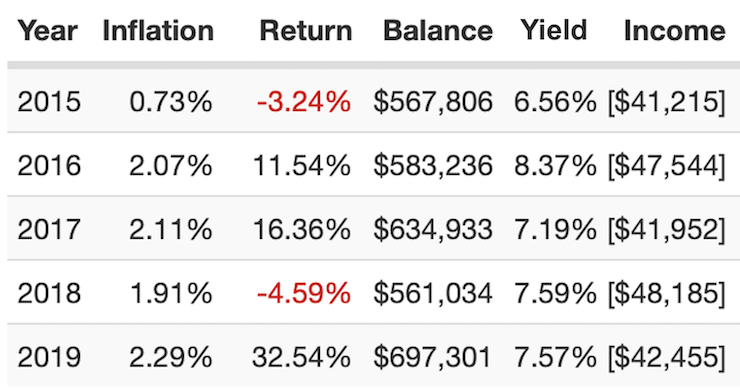

As a reminder, our retiree from the original example needed $43,995 each year to cover expenses. Here’s what the portfolio produced in prior years:

Here is the income produced in 2020 and through the first two month of 2021:

The portfolio’s income never missed a beat! The interest and dividends were consistently paid out. The income the portfolio produced was completely independent from the price changes that occurred in March 2020.

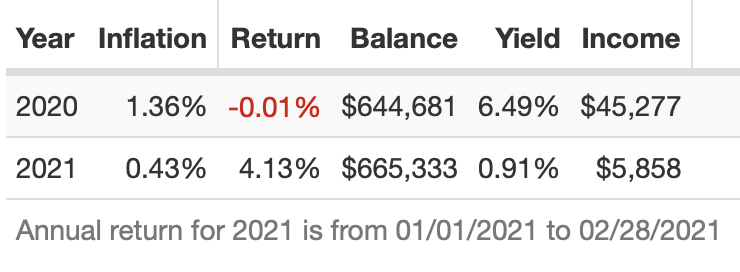

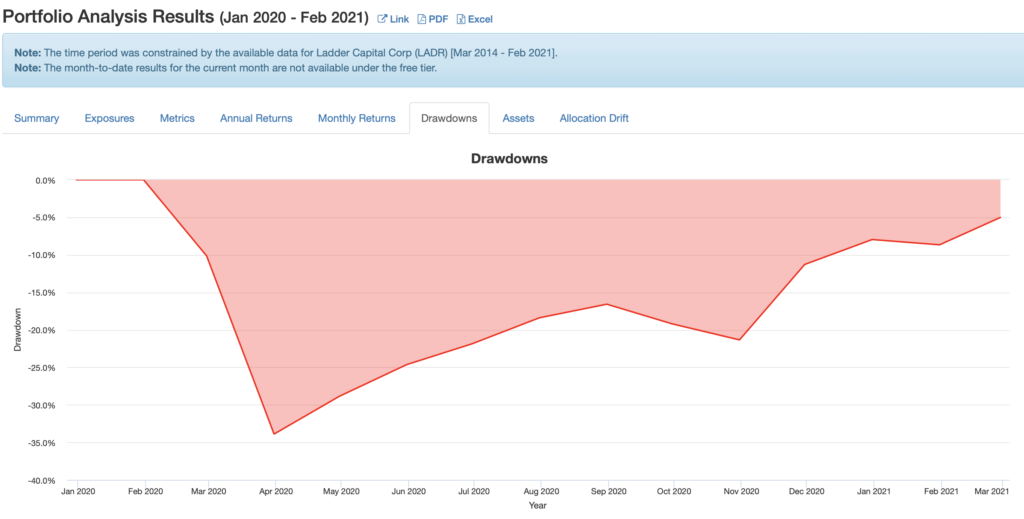

Portfolio value

The portfolio’s total value definitely took a hit, just like everything else, in February and March of 2020. At its low, the portfolio was down -33.89%. That is right in line with the S&P 500 index as a whole (S&P 500 index closed at 3,386.15 on 2/19/2020 and closed at 2,237.40 on 3/23/2020, a decline of 33.92%).

We started February 2020 with $697k. At its low, the portfolio balance hit $460,986. That looks like a scary number if you just retired! The income didn’t change just because the prices dropped, though! By keeping the faith (and continuing to receive the same income) the retiree was able to stay fully invested. The portfolio is back to $665k at the end of February 2021. The portfolio value is not quite back to its high, but it’s still above the $628.5k the original article started with.

Individual holdings

As we just discussed, the portfolio as a whole handled the ultimate stress-test extremely well. But how did each individual investment choice do?

Each fund holding was negative in February and March of 2020. There’s no way around that when people are fueled with pure panic like they were during that time. Municipal bonds handled it the best, though, losing between 7.5% and 13.2% in March. REITs were slaughtered, losing anywhere from 33% (OHI) to 68% (LADR).

Looking back at the information now, it looks like LADR is the only holding that suffered a permanent loss of capital. It was at $18.86 on 2/14/2020 and is currently at $12.18 (3/19/2020), or 35.4% off of its high. Ladder’s performance isn’t too surprising considering nearly half of its portfolio is located in the Northeast and West Coast, two areas with prolonged and more extensive lockdowns.

That means the other twelve funds were worth holding onto. A 12-1 record will make you a lot of money over the long-term!

Wrapping up

The most concerning issue new retirees face is ‘sequence of return’ risk. That’s when the worst returns during retirement happen right when you retire. Most early retirement gurus will tell you the way to combat sequence of return risk is to plan on an extremely low withdrawal rate (less than 4%).

I’m here to tell you that the source of your investment income can also combat sequence of return risk, and the portfolio I used as an example a year ago just proved that during one of the most severe downturns we have seen.

You can have a 7% withdrawal rate and make it through any sequence of return issues. The key reason why is that dividend and interest income is much more stable than security prices. If you have enough dividend and interest income to sustain your lifestyle, you can wait out any downturns in prices without having to deplete your shares at depressed prices.

I hope you enjoyed this ‘contrarian’ viewpoint and it makes you reevaluate your own portfolio for reaching financial independence!

PS – Here’s a link to the portfoliovisualizer page if you want to check out the portfolio yourself.