Improve on the 3 fund portfolio by combining a diversified stock ETF with better bonds.

This article will show you how small tweaks can improve the 3 fund portfolio.

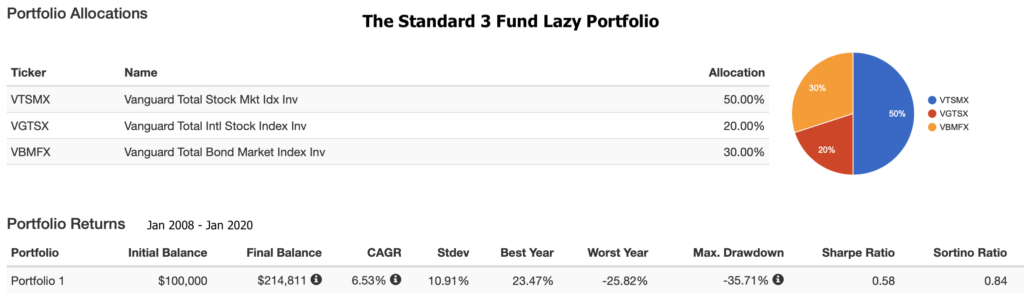

Your standard 3 fund portfolio

If you go anywhere near Vanguard or the Bogleheads site, you’ll see a 3 fund portfolio that looks something like this:

- 50% VTSMX (Total stock market)

- 20% VGTSX (Total international stock market)

- 30% VBMFX (Total bond market)

You can use the admiral share versions for even lower fees: VTSAX, VTIAX, VBTLX.

Here are the returns of the mutual fund portfolio:

Yes, its also called the “Lazy” portfolio but that’s not an insult. In this case, being lazy is seen as a positive attribute.

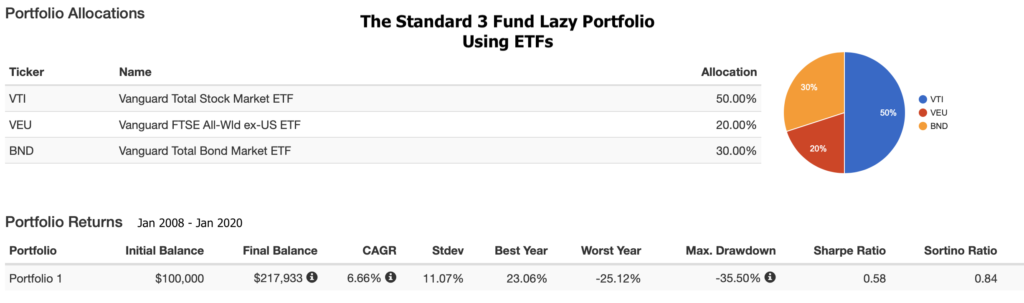

Here’s the ETF equivalent (and of course we like ETFs more):

- 50% VTI

- 20% VEU or VXUS (pretty much the same fund, but VEU has slightly higher yield right now)

- 30% BND

And here is the ETF portfolio information:

The results are extremely close, but the ETF version did beat the mutual fund version from Jan 2008 – Jan 2020: compound annual growth of 6.66% vs 6.53% for the mutual funds. A final balance of $217,933 vs $214,811 for the mutual fund version over the same time period.

Those are both fine portfolios. The logic behind the three-fund portfolio is that it’s difficult to beat the market average return consistently so you are better off just matching it. A lot of people trying to reach financial freedom use that template. It gets you 90% of the way to the finish line, which is way better than what a typical investor is doing.

You would do very well with either of those portfolios, but –

What if you could make a small change and do even better?

Let’s focus more on the fixed income side. You can do sooooo much better than mutual funds or ETFs when it comes to bonds. You see, the bond market is not as efficient as the stock market, and market cap weighting doesn’t work the same for bond funds. Active management really will pay off on the fixed income side of your portfolio.

We are going to choose two closed-end funds: NVG and NSL. NVG is a municipal bond fund and NSL is a senior loan fund. Both funds are managed by Nuveen, some of the best fixed-income managers out there. Both funds average around a 6% distribution rate. NVG is a little lower now because it’s had a big price run-up over the last year.

Pro tax tip: hold NVG in your taxable brokerage account and NSL in your tax-deferred account.

They balance each other out almost perfectly. That’s because they react to changes in interest rates in the opposite way. NVG will go down as rates rise while NSL will go up as rates rise. Imagine you have $100,000 in the fixed income portion of your portfolio. You put $50,000 into NVG and $50,000 into NSL. As one goes up in price, the other goes down. They balance each other out while you collect 6%. Let’s say municipal bond funds go on a huge bull run so at the end of the year NVG is worth $60,000 and NSL is down to $40,000. You still have the same $100,000 investment and you’ve been collecting 6% the whole time.

Pro investing tip: you don’t want everything in your portfolio going up at the same time. You want some investments negatively correlated so they act as a buoy when other investments start sinking.

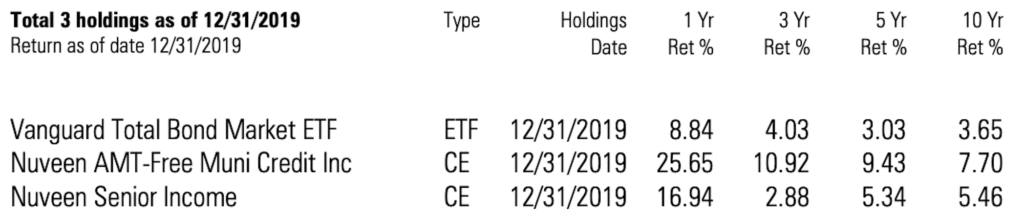

Here’s how Nuveen AMT-Free Muni Credit (NVG) and Nuveen Senior Income (NSL) have performed compared to Vanguard Total Bond Market (BND) over various time periods.

There’s clear outperformance taking place. Earning an extra 2%-4% over 10 years leaves BND in the dust. These results also don’t take into account buying NVG and NSL at opportune times. You see, BND’s price is always equal to its net asset value (NAV), but closed-end funds can sell at a discount, often 10% lower than the NAV. That leads to even more performance gains than what these numbers show you.

One argument someone might make is that closed-end funds are expensive! Here’s the deal: their distribution rates are net of fees. NSL pays more than double what BND pays after that ‘expensive’ fee is deducted. You basically have some of the best bond managers in the world working for you for free. Would you rather collect 6% after fees or 3% with low fees?

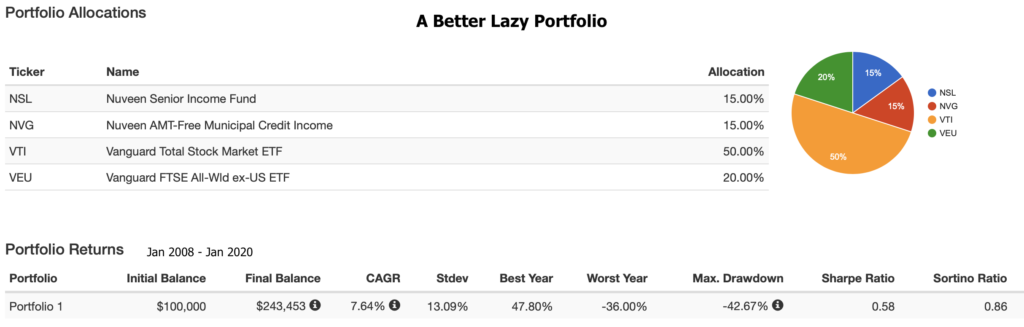

Putting it all together, here’s how the portfolio looks with the improved fixed income:

For the time period Jan 2008 – Jan 2020, your compound annual growth rate is now up to 7.64%. That’s an entire percentage point higher year-over-year versus the standard three-fund portfolio! Your final balance equals $243,453 versus the $217,933 we calculated earlier. That’s a real difference and that’s only over 12 years. The difference will just get larger as more time goes by.

Impressive, but four funds is too hard!

No problem, let’s take it back down to three. Since we’re already set with the better fixed-income portion of the portfolio, let’s now focus on the equity portion. We’ll replace VTI and VEU with Vanguard Total World Stock (VT) for our equity holdings. That’s right, one fund. Put all 70% into it. VT is an ETF that combines stocks from all over the world. It’s 58.3% U.S. companies, 18.5% Europe, 12.6% pacific, and 10.2% emerging markets. 8,423 companies in total. Full diversification in one fund. If you are stuck using mutual funds, choose VTWIX.

From a performance standpoint, VT has lagged behind a holding of VTI & VEU over the last few years. The reason? It holds about 13% more international holdings vs putting 50% in VTI and 20% in VEU. International stocks haven’t done as well as U.S. stocks lately. Simple as that. But that also means there is better value in international stocks right now, and international stocks are expected to outperform U.S. stocks over the next decade. That will add even more fuel to VT/NSL/NVG outperforming the standard 3 fund portfolio over the long term!

The only thing left to do now is to rebalance periodically. Let’s say fixed income moved sideways during the year, but VT went up 30%. You would want to sell some VT and add to NVG and NSL to get your allocation back to 70%/15%/15% (or whatever you chose for your risk tolerance and goals).

How does it compare to the standard 3 Fund portfolio?

It’s clear that replacing BND with NVG & NSL improves your portfolio. They have a higher total return due to the active management from Nuveen. They have much higher income which helps smooth out any hiccups in the market. It’s pure win on the fixed income side.

Getting smarter with your fixed income leads to better performance and higher yield while sticking to three funds. Was it really even that much more work? Not really, just read up on closed-end funds. Closed-end funds are amazing investment vehicles, but they aren’t big enough for the huge investment firms to use so you might not have heard of them before.