Figuring out your net worth is an important step in gaining financial freedom.

In a nutshell

Net worth is an important calculation because it dictates how much income you’ll have in retirement. Add up all of your assets and subtract out all of your debts. What’s left is your net worth. Ideally, you want to see a positive number there, but based on what stage of life you are in a negative number can be OK! This figure simply tells you how close you are to financial independence; no big deal.

Your net worth will show you what retirement will look like.

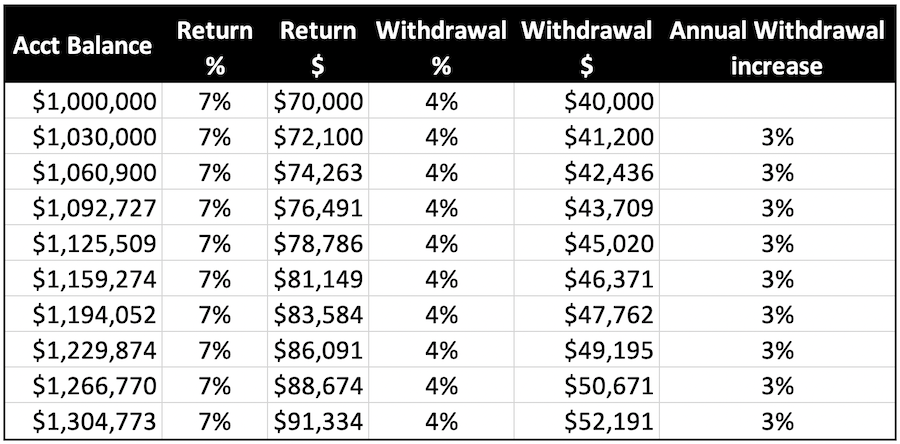

Your net worth tells you how close to FIRE you are. How? Take your net worth and multiply by 4%. That’s the amount of income your net worth can afford to pay out each year. A good investment plan should earn about 7% a year so you can take out 4%, and the remaining 3% of earnings that stay in the investment plan will allow your yearly withdrawal to keep pace with inflation. There’s no loss in purchasing power no matter how long you stay in retirement! A lot of others will try to make it more complicated than that, but there’s no need to. It will look something like this:

As you can see, once you hit your net worth number and have your investments set up properly, you are officially financially independent!

Let’s dive deeper

A business keeps track of a balance sheet, and you should run your personal finances like a business. Your net worth is the balance sheet of your financial life. It gives you a good snapshot of where your finances currently stand.

To go more in-depth on what to add and what to subtract, there are some good templates available just by googling, like Schwab or Morningstar. I think it helps to print out a worksheet and write the numbers down the first time you go through this exercise. Afterward, you can track with an app like Mint or Personal Capital, or even build your own spreadsheet in Excel or Google Docs. Either way, I promise calculating your net worth doesn’t involve any advanced mathematics!

Assets

For the most part, you will be adding (positive values):

- Your primary residence

- Any other residences or real estate you own

- Bank accounts

- Investment accounts (both retirement and brokerage accounts)

- Your car(s)

- Any other valuables you have, such as jewelry or artwork

You could technically include all of your belongings since they have some sort of value, but I don’t think it’s practical to A) add up every DVD, piece of clothing, and random battery stuffed in your junk drawer, and B) to think you’ll readily find buyers for all of those things at the price you think they’re worth!

Liabilities

What will you subtract?

- Mortgage you have on any of those residences or real estate

- Home equity loans or lines of credit

- Installment loans for cars, boats, or other vehicles

- Student loans

- Personal loans

- Credit card debt (just the balance you carry month-to-month)

Remember, all of these values should be the balances on the accounts, not the monthly payment.

Example 1: Your mortgage has a balance of $90,000 and your monthly payment is $1,300. You should be putting the $90,000 balance on the net worth worksheet.

Example 2: You spend $2,000 a month on your credit card but pay it off each month. You don’t have any credit card debt; that’s just your monthly spending. If you carried a balance from month-to-month, then you have a credit card balance to put on your net worth worksheet.

Stockholder’s Equity (hint: you’re the only stockholder)

Once you have all of the items written down, it’s as simple as subtracting all of your liabilities from all of your assets. You’re left with one number. Businesses call it stockholder’s equity. In personal finance, it’s your net worth. It could be big or small, positive or negative.

Now you can see how you stack up to everyone else in this interactive chart. To clarify, I don’t think it matters where you rank for your age group. The direction you are heading is much more important. The way Zach, at Four Pillar Freedom, presented the data is just so cool that I had to share it. Ok back on track…

How can I tell if my net worth is where it should be?

If you have a positive number, you are on your way to financial freedom! Now we can figure out if you’ve already reached FIRE or determine how much of a gap still exists.

The first step is to take your current net worth and multiply it by 4%. (example: $800,000 net worth x 0.04 = $32,000)

Now we need to compare that to your annual expenses. You know your BIG, right? If not, go get it. I’ll wait.

Ok, now that you have the one big expense number you need to remember, here’s step 2:

Take your BIG, multiply by 12 to get your annual expense amount, and compare it to the 4% withdrawal amount you calculated above. If the numbers match or the 4% number is bigger, congrats! You’ve reached financial freedom since your net worth can support your spending. Go ahead and yell it out, make William Wallace proud:

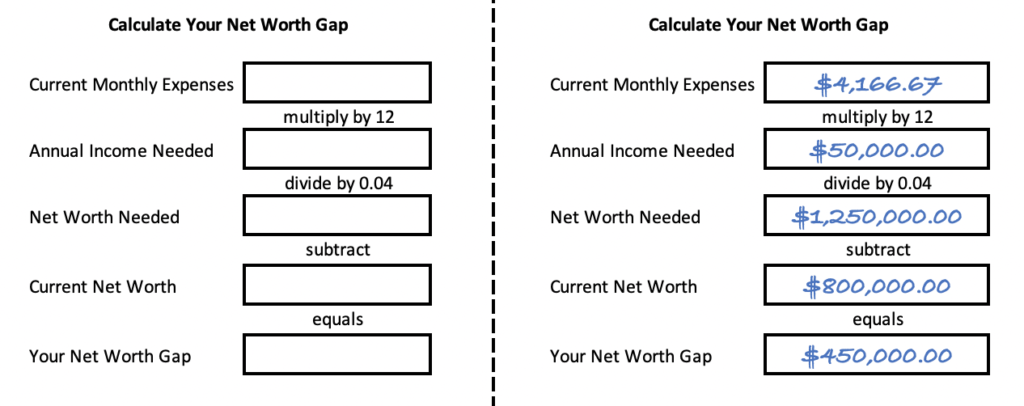

If you aren’t in FIRE range yet, let’s figure out how much of a gap you have left. Here’s a chart to see what kind of gap you’re working with, along with an example already filled in.

In this example, you have a solid net worth of $800,000 but you need $450,000 more to support your level of expenses. Now you know exactly what gap you need to close. You are no longer guessing and have a concrete goal to achieve.

By the way, an extremely frugal person with an $800,000 net worth might already be in the FIRE zone!

Help, I’m going the wrong way!

What if you have a negative number? Does that mean you’ve failed and have no chance of getting on track? Not necessarily. It all depends on your cash flow. If your cash flow is positive you have a good chance for success! If your cash flow is negative it’s time for a serious sit-down meeting with yourself to get things back on track. Negative cash flow will destroy your net worth. Since net worth is the engine for financial freedom, that would be devastating. Getting a negative cash flow to positive should be your highest priority!

Check this out to get a clearer picture of your cash flow.