Paying off your mortgage as fast as possible is a popular personal finance mantra – but should you pay off your mortgage early?

In a previous article we explored buying a home versus renting and investing the difference. We’re now assuming you ran the numbers and decided buying is best for you. On to the next question – should you pay off your mortgage early or invest the extra money?

One of the most often asked questions from our clients is what should they do with extra money? Almost all of them think paying down their mortgage is a good idea.

Their thought process goes something like this: once it’s paid off, I’ll be able to put more away each month and end up with more overall. A) No, you’ll spend some of it on lifestyle creep, and B) even if you did save it all, the math still doesn’t end up in your favor.

Most reasons for paying off a mortgage early are all psychological and can be debunked as not the best use of your dollars:

- I want to own my home outright.

- I don’t want to owe the bank or mortgage company money.

- I don’t want to pay all that interest for thirty years.

- Debt is risky so it is safer not having any debt.

Paying down your mortgage guarantees you a certain return. That return will equal the interest rate on your mortgage. Have a 3% mortgage? You’re guaranteeing a 3% return on that money. Are you happy with that? Is that the best use of your dollars versus averaging 8% with an investment account?

How do the numbers look if you put extra money towards paying off your mortgage rather than invest it?

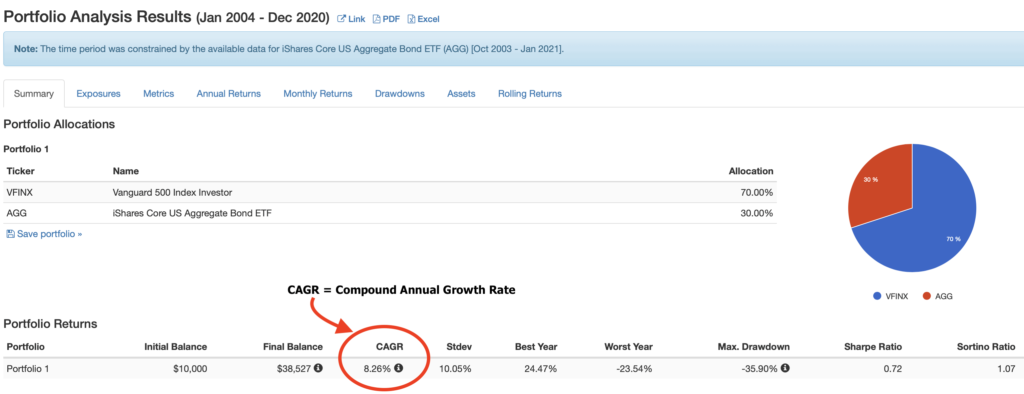

What if you pay an extra 20% each month towards your mortgage? I simulated a bunch of scenarios with varying interest rates, investment return rates, and beginning mortgage amounts. Every scenario showed that as long as your average investment returns are higher than your mortgage interest rate, you are better off investing. That is an easy threshold with 3% mortgage rates right now!

The same holds true even if you make an extra 100% payment towards principal each month.

You could even have a 0% return on your investment account for forty years and only trail paying off the mortgage early by $37,000 (on a $100,000 mortgage). Any reasonable return (8%) would give you an extra $462,000 over forty years. A more-than-likely chance at an extra $462k versus a very unlikely chance at a $37k loss is a good bet to make!

You can use any multiple of that to match your mortgage; if you have a $200,000 mortgage double those numbers, $300,000 mortgage triples those potential numbers, and so forth.

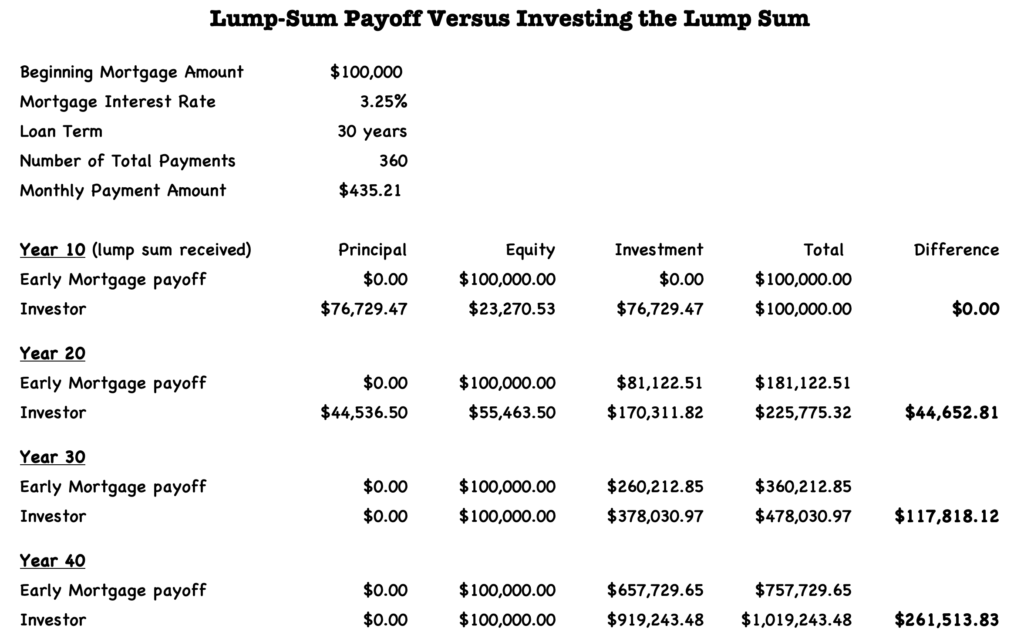

What about a lump sum?

If you come across a lump sum of money (think inheritance or lottery) it might look like an easy decision to just put it towards your mortgage and get it paid off asap. But… the numbers still don’t work in your favor! The reason is compound interest. A lump sum invested will compound at your investment rate (8% in my example) while paying off the mortgage limits your gain to the 3% interest rate from the mortgage you just paid off. You then have a small amount (relative to the lump sum) to invest at 8% and start compounding at that rate.

After thirty years, when the stock investor’s mortgage is paid off, the investor is $117,000 ahead of the early mortgage payoff. After forty years, the investor is $261,000 ahead.

To reiterate, you have to expect a long-term investment return equal to your mortgage interest rate for the lump sum payoff to start making financial sense.

What if I want to do a fifteen-year mortgage?

Maybe you’ll do a fifteen-year mortgage instead of thirty-year. That’s the exact same thing as paying off your mortgage early! You could get a thirty-year mortgage and pay extra each month to have it paid off in fifteen years. The overall payment would be the exact same (assuming the same interest rate) but you’d have the flexibility to pay the lower amount if you fell on hard times. You could also invest the difference for the first fifteen years and then make a lump sum payment and have it paid off. You would still have $31,000 left over in your investment account if you went that route. More flexibility and more money combine for a winning combination.

“More flexibility and more money combine for a winning combination.”

Does the state of the economy make a difference?

Some will say the answer depends on the economy; if times are good you should hold onto the mortgage debt and invest. If things are going badly, avoid investing risk and lower the amount of debt you have. I say that’s the definition of bad market timing. If stocks are tanking, that’s the time to invest and ride the long wave up afterwards! You’ll make far more investing at that time than you will paying down mortgage debt.

Other negatives to paying off your mortgage early

Your mortgage payment will get cheaper over the years! No, not in absolute terms; you’ll still be making the same payment amount. But that amount will become smaller relative to your income. Your income will increase a great deal over the next twenty to thirty years but that mortgage payment will stay the same. It will take up a smaller and smaller portion of your budget.

Paying off your mortgage early ties up that money – its now stuck in an illiquid asset. The only way to access it is to have a home equity line of credit set up. That could be tough to do as banks tighten up during bad economic times. Having the money in an investment account gives much more flexibility during any tough times. That flexibility will give you more peace of mind than not having a mortgage.

Paying off your mortgage only takes away part of your home expenses. You’ll still have property taxes, home insurance, maintenance, and repairs. You never own your home free and clear; try not paying your property taxes and you’ll see how much of your home you really own. It’s possible to not have home insurance when the mortgage is paid off but that would be disastrous. Try seeing what happens to your home’s value if you neglect maintenance and repairs. You will still have home payments with a mortgage or without.

Paying off your mortgage eliminates a source of tax write-offs and the higher your taxes are the more benefit you will get from the tax deduction. If you are in the highest tax bracket (39.6% as of this writing), the tax deduction would effectively reduce your 3.25% mortgage rate all the way down to 1.96%! Even a moderate tax rate of 24% would give your mortgage an effective interest rate of 2.47%. The caveat being you have to itemize your deductions to benefit from SALT deductions.

Conclusion

In today’s ultra-low interest rate environment, paying off your mortgage early just doesn’t make good financial sense. Why retire 3% debt that comes with tax advantages? Invest the money earning an average return (8%), and you could add hundreds of thousands of dollars to your net worth.

Remember, the interest rate on your mortgage would have to approach your investment return for the numbers to work in your favor. And even then, the risk (the missed opportunity of paying off the 3% interest debt) is tiny compared to the potential gains in your investment accounts.

*Assumptions made in this article’s examples:

- All mortgages were for $100,000 at a 3.25% interest rate for 30 years (360 payments of $435.21)

- Extra 20% payment towards the mortgage: additional $87.04 per month (271 payments of $522.25). Brokerage account invested the additional $87.04 each month and earned 8% annually.

- Extra 100% payment towards the mortgage: additional $435.21 per month (138 payments of $870.42). Brokerage account invested the additional $435.21 each month and earned 8% annually.

- Lump sum payoff: Mortgage balance after 10 years (payment #120) was $76,729.47. Brokerage account invested the entire $76,729.47 and earned 8% annually. Lump sum payoff put the entire amount towards the mortgage, and then invested the monthly savings ($435.21) in a brokerage account earning 8% annually.

- 15-year mortgage vs 30-year mortgage and investing the difference between the two plans: 15-year mortgage payment is $702.67. 30-year mortgage is $435.21. Difference is $267.46. Brokerage account invested the additional $267.46 per month and earned 8% annually. Investment account had $93,168.39 after 180 payments. The 30-year mortgage balance was $61,936.20 after 180 payments. Investor paid off mortgage and had $31,232.19 left over.