Debt can be a tool used to improve your life but if it’s not used smartly debt could ruin you financially instead.

We’ll first take a look at what debt is and how it can be used. We’ll then dive into the secret of using debt to your advantage. It’s easier than you think.

What is debt?

In its most basic form, debt is borrowing money from someone now and paying them back later. The person lending you the money will want something in return for the risk they are taking. What risk? There’s a chance you may not pay them back! So, you have to agree to pay them back the original amount plus a little extra called interest. The amount of interest will be tied to how much risk the lender thinks they are taking on; do they think you will easily repay the loan, or do they think you will struggle to repay? The higher the risk, the more interest you’ll have to pay.

There’s all kinds of reasons people borrow money, and there’s all different kinds of entities that will loan the money out. Let take a look at some common ways people use debt and how they go about obtaining the debt. Make sure to read to the end for the easy solution on using debt in a smart, efficient way. Otherwise, it might begin to feel like a trap…

Types of debt

Secured versus unsecured

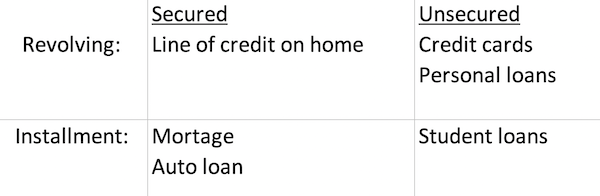

There are couple different ways to categorize debt. The first is whether the debt is secured or unsecured. Secured debt is going to have an asset attached to it in case you fail to pay back the loan. A mortgage is the easiest example: if you don’t pay the mortgage back, the bank gets the home as payment. A car loan is secured by the car. Any asset being used as collateral will have a lien on it. That just shows another entity has an interest in the asset until the loan is paid back, and then the lien is released.

Opposite secured loans, you have unsecured loans. Unsecured loans do not have any sort of asset committed towards the payment. In case it’s not obvious, unsecured loans are riskier for the lender so they are going to want a higher interest rate in return. Credit cards are unsecured debt.

The best way to see the difference in interest rates between secured and unsecured loans is with a personal loan. Most personal loans are unsecured. They are just based on your credit history. There are some secured personal loans, though. They can be secured with something like a CD with a long maturity and high prepayment penalty. The difference in interest rates between those two loans will give you an idea of how much the lender wants some sort of asset as collateral.

Revolving versus installment

The next way to categorize debt is how it can be utilized and paid back. First, you have installment loans. This is the typical loan you think of: you borrow a certain amount up front, and then you make the same monthly payment until it’s all paid back. Once it’s paid back the agreement is over. Mortgages and car loans are good examples.

Instead of being locked into the amount borrowed and the amount you pay back, a revolving debt will give more flexibility. A credit card is the easiest way to think of revolving debt. The credit card may have a limit of $5,000 and you can use the entire amount. As soon as you pay it off, you have access to the $5,000 again. A line of credit works on a revolving basis as well.

Now we can see how some common borrowing situations fit into that framework

Mortgages

You need a mortgage when purchasing a home. Banks and other financial institutions are the main lenders for mortgages. Since the home is collateral for the loan, banks generally offer very low interest rates compared to other types of debt. Since mortgages are usually for large amounts of money, they are paid back over a long time – 15 to 30 years. You can have a fixed rate which stays the same over the life of the loan or you can have a variable rate. A variable rate will adjust each year based on the current prevailing rates. Fixed rates are much safer for you, the borrower.

Car loans

Financing a new car purchase will lead to an installment loan similar to a fixed-rate mortgage. Since it’s a smaller amount it’s paid off over a shorter time period (usually 3-5 years, sometimes up to 7 years).

Student loans

Student loans are another type of installment loan. Once you are finished with school and the grace period is over, you’ll generally make the same payment each month until its paid off. Student loans are considered unsecured because there’s no asset for the lender to take if you don’t repay the loan. Therefore, student loans will have higher interest rates than the secured mortgages and car loans. To an astute observer, though, there is an asset attached to student loans: a smarter and more marketable you!

Personal loans

Personal loans can be utilized for any purpose. Most of them are not secured by an asset since the lender might not even know what you plan on using the money for. The lender is basing their decision on your credit history and your current income and expenses. Personal loans can have quite high interest rates due to this risk. There are secured personal loans as well but they are fairly rare with limited options for assets that can be used as collateral for the loan.

Business-related

If you are looking to start or expand a business, there are some other options available. If you are looking to purchase real estate for a business objective, you might need to look at a commercial loan instead of a mortgage. Commercial loans will almost always have higher interest rates than a mortgage. They also usually include something called a balloon payment. That means you make regular loan payments for a set number of years, like 5 or 7, and then they expect you to pay off the remainder of the loan in a lump sum. You either need the cash ready to go or have other financing lined up!

For businesses that aren’t very attractive to regular banks may have to look at hard money loans. These are generally done through individual investors, have much higher interest rates, and are collateralized by the asset the money is being borrowed for. Hard money loans are seen as a short-term solution and are paid back in a year (sometimes 2 or 3).

Credit cards

Credit cards are the main type of revolving debt you use. I’m sure you are familiar with credit cards so I’ll just point out the most important aspect – always pay off the credit card balance each month. As long as you do that you will not pay any interest.

Line of credit

A line of credit is the other main form of revolving debt. Most often, you’ll see it as a HELOC (home equity line of credit). A bank will give a line of credit to you based on how much equity you have built up in your home. If your home is worth $400,000 and your mortgage has a balance of $250,000, then you have equity of $150,000. A bank might give a limit of $70,000. You can then use that $70,000 for whatever you want. Maybe you use $10,000 to build a deck and pay it off. A couple years later you use $30,000 to put a pool in the backyard and pay that back. As you can see, it’s revolving – you have access to use it as you want. HELOCs generally have a ‘draw’ period of 10 years. That’s when you can use it as you want to. After that, it goes into the ‘repayment’ period, usually 20 years. During the repayment period, you can no longer borrow any money from the line of credit; it’s purely just to pay back any outstanding balance. If there’s no balance at the end of the 10 year draw period the HELOC will just close at that time since the repayment period isn’t needed.

That all seems pretty straightforward. So why are there so many financial experts pounding the desk about how bad debt is? Keep reading to discover the main issue with debt – and the easy solution!

My college education on debt

My own introduction to debt happened during college. Walking between classes and the student union, there would be tables set up with people hawking different goods and groups. One was giving free t-shirts out to anyone that signed up for a credit card. Hell yeah, I wanted a free t-shirt! So I signed up for the credit card. (Obviously my time in college was before the CARDs Act of 2009.)

Then I started using the credit card. Initially, I only charged what I could pay off each month but after a few months there were some expensive speakers I really wanted. I put them on the credit card. At that point I was no longer paying off the card each month; I was carrying a balance and only making the minimum payment. It didn’t matter to me if I was carrying a $200 balance or the card’s $500 limit. I was still only paying a small portion of it each month. Once that card was maxed out, I decided to get another free t-shirt!

Now I had one card maxed out and was starting the same process with a second card. Without realizing it, it played out the exact same way as the first card. Maxed out. The third and fourth free t-shirts went the same way. At this point I had four maxed out credit cards and I was struggling to pay the four minimum payments each month. The only saving grace was the banks were smart enough not to trust me with more than a $500 limit on any of the cards.

I ended up borrowing money from a friend to make payments one time before my next scholarship check came in. That was a pretty low point. Eventually, I let my mom know how dumb I had been and she bailed me out. Yes, I understand how fortunate I am to have friends that trust me enough to loan money and family in a position to help me financially. I also understand how amazing it was to have a scholarship and avoid student loans.

I think a lot about how it could have gone, though. What if I had a bunch of student loans on top of the credit card debt? And what if my parents weren’t able to offer a bailout? How long would I have struggled to get out from under that debt? As meticulous as I am now with my finances, I can’t believe I ever fell into that trap! The bailout didn’t stop me from learning my lesson, though, and I’ve never carried a balance on a credit card since.

The part that really gets to me about that experience, though, is this: here I was taking college-level courses on business finance, but I wasn’t learning anything about controlling my own personal finances. Millions of others have fallen into the same trap as I did. How could they not without more education? A big part of my motivation is to teach those basic personal finance skills. Financial independence will always just be a dream without understanding the basics of personal finance.

Here is one of those important lessons that will put you ahead of 95% of society:

There is ‘good’ debt and ‘bad’ debt. The difference is how you utilize it.

Good versus bad debt

This is a source of contention on the internet: is there such a thing as good debt? Bad debt, like paying 20% on credit card balances, is universally hated. NO ONE will tell you paying interest on a credit card is a good idea. If you buy something for $100 on a credit card and slowly pay it off over the next year, that widget ended up costing about $120 once you factor in the interest you are paying on that debt. If you only make minimum payments which stretches out the payoff period over multiple years, you could easily end up paying double, $200, for that same item. That’s right. You pay as much in interest as the item itself cost.

Some people will say certain types of debt, like a mortgage, is good debt because it allows you to obtain a larger asset at low-interest rates. Some people will tell you no debt is good because you can’t be free as long as you owe someone else. Or debt is bad because you want your expenses as low as possible before retiring. They want you to pay off that mortgage as quickly as possible so you don’t owe anyone. This way, if you hit a hard time, the bank won’t be looking to take your home back.

I have news for that line of thinking, though: mortgage or not, you still don’t truly own your home. Don’t believe me? Try not paying your property taxes for an extended period of time and see what happens.

Despite the naysayers, there is such a thing as good debt. There’s an important mental exercise everyone needs to do before taking on debt: evaluate the cost you are borrowing now versus the value of that asset in the future. Good debt allows you to grow your net worth. Bad debt will eat away at your net worth. It’s that simple.

This is the key: successfully managing debt boils down to recognizing good debt versus bad debt.

Let’s look at some examples:

-Picture taking out a mortgage for a home. You expect the home to go up in value as you slowly repay the loan. You bought an asset that is increasing in value and will be worth more than what you borrowed. Good debt.

-You take out student loans because you expect an advanced degree will let you earn more every year for the rest of your life. Good debt.

-Now picture a car loan. You borrowed money to buy a brand-new car. As you drive the car for the next five years, you slowly pay down the loan, but the asset is also going down in value. Yes, a car is an asset but it’s not a very good asset because it is a depreciating asset. The car will be worth less than what you originally borrowed. Bad debt.

-Credit cards? Even worse. You are probably borrowing money to buy things that aren’t even assets! Go out to brunch with your friends and put the tab on your credit card that you carry a balance on? Those items are worth zero the moment you consume them, but you will be paying for them for months or years with nothing to show for it. Terrible debt!

Now, those are obviously just some quick generalizations I put together. But people take those generalizations and apply them to their own life without actually evaluating their circumstances! If you want to be a carpenter, then taking out student loans for college is a waste. Go straight to work for another carpenter and learn the skills and trade needed. Student loans would be bad debt in your situation.

If you borrow the max the bank says you can ‘afford’ to buy a house that’s overpriced, you’re going to struggle to make the payments and it will put a strain on all of your other financial obligations. The mortgage could have been good debt, but you did it in such a dumb way that it became bad debt for you.

Debt isn’t automatically a bad thing. It’s not evil on its own. It only becomes some hated entity when people take it on without understanding the equation. You need to evaluate your own situation each time you are thinking about taking on debt.

Always remember that you are in charge of your financial life. It’s up to you how smart you want to be with your money. No one else even cares about your finances unless, of course, they’re trying to take some of it for themselves.