Wondering how much your home will appreciate in value? Let’s take a look at historical data and see what that tells us about future home prices.

There are many thoughts and emotions going through your mind when you purchase a new home. You picture your children growing up and playing in the backyard. You mentally decorate each room before you’ve ever moved in. You imagine all of the great times with friends and family you’ll have in the home. Maybe you even think about how much the home will increase in value; will this property make you rich?

There’s a prevailing sentiment that purchasing a home is a great investment no matter what. “Real estate always goes up!” someone will always say. You would think 2008-2009 tampered that enthusiasm but home prices are already higher than they were during that bubble!

So, what type of return should you realistically expect when you buy a home?

Let’s cut right to the chase and burst that bubble: a typical homebuyer should expect their home to increase in value by inflation each year. That’s it! I know that surprises a lot of people but there’s plenty of research on historical values that point to a strong correlation between home price growth and inflation.

There can be big price swings up or down in the short-term, just like any other investment. Over the long-term, though, you should expect your home value to increase by inflation.

Why do home price increases match inflation?

Personal Capital has a nice explanation for why that correlation exists. Here it is in their own words:

“Historically, home prices appreciate at around the rate of inflation with meaningful variability in either direction. This makes sense. The value of a home is tied to its ability to generate cash flows if rented. Rent generally appreciates with inflation and if it gets too high builders are happy to create new supply. With stocks, companies can grow earnings above inflation in many cases, so the overall rate of growth can be higher. Low interest rates support higher prices for both because they lower the cost of capital and establish a lower bar for what investors will accept as a reasonable return.”

-Personal Capital Market Review & Outlook, Third Quarter 2020

While they don’t go into it, Personal Capital’s analysis can also explain why certain areas like New York City or Los Angeles can expect values to increase by more than inflation – builders have run out of room to create new supply.

But home prices have been rising faster than inflation for decades!

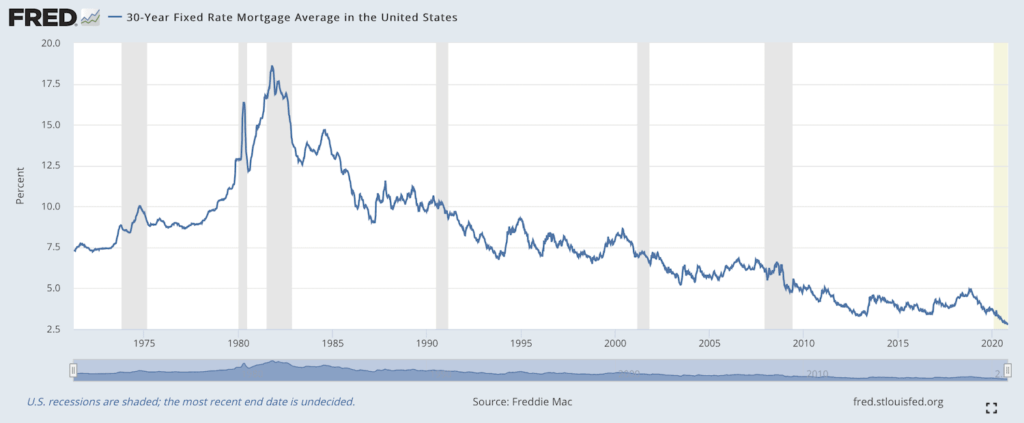

Falling interest rates have also helped home price growth outpace inflation over the last thirty or forty years. You could afford a more expensive house because your mortgage payment would be lower with a lower interest rate.

From January 1987 through December 2019, home prices increased by 3.71% a year (St. Louis Fed). Inflation over that same time period was 2.57%. So, in the time period where homes seemed to have their most explosive growth, home values outpaced inflation by a whole 1.14% a year! The tailwind of decreasing interest rates is going away, though!

As interest rates rise (they can’t go much lower from here), it will suppress home prices simply because people won’t be able to afford the more expensive mortgage payments.

Going forward, you should expect a headwind from rising rates. Maybe not for the next couple of years but definitely as a long-term trend. That will make home price growth revert to its mean. It could even lead to price growth that’s less than inflation so make up for the last thirty years where we saw home price growth higher than inflation.

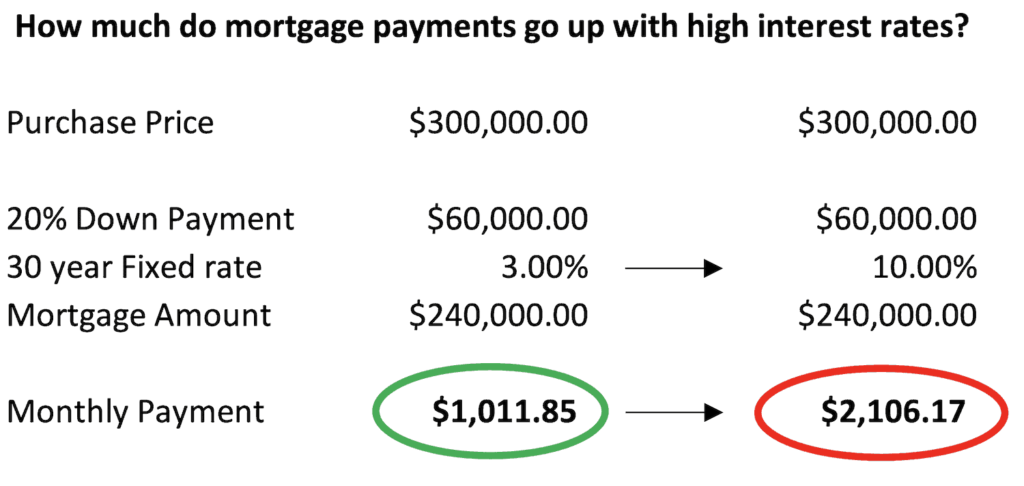

Let’s go over an example to drive this concept home. Mortgage interest rates were around 10% in 1990. Today, they’re around 3%. Here’s how much that affects the price of the home you can afford:

Wow! Your mortgage payment would more than double from $1,011 to $2,106 for the exact same house and the only difference is the interest rate on your mortgage.

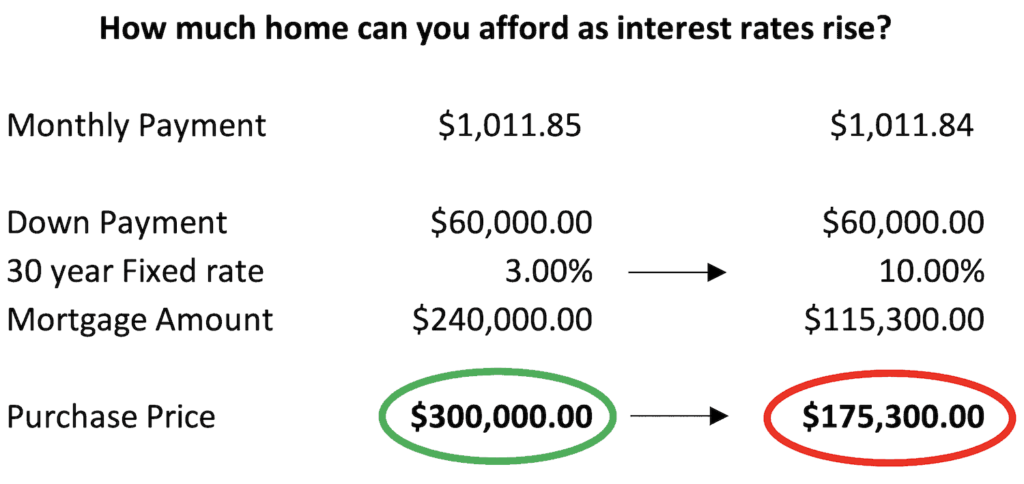

What if you could only afford the $1,011 a month mortgage payment but interest rates were 10% – how much house could you afford in that scenario? Well let’s assume you were able to save up the same $60,000 as before:

That’s right, even with your larger 34% down payment, you can still only afford a home valued at $175,300. That’s a 41% decrease in the amount of home you can afford if rates rise from 3% to 10%.

I know that seems like a pretty extreme rate-hike but it has happened before. Under Paul Volcker’s Federal Reserve, the early 1980s are a prime example of just how high rates can go. A 30-year mortgage came with an 18.5% interest rate in 1981! Inflation was already high and he made interest rates even higher to beat it.

Or it could happen gradually, over a long period, under Jay Powell’s new Fed policy of ‘average inflation’.

Conclusion

Hopefully we’re on the same page now with what to expect from your home’s price growth going forward. Now that you are expecting your home to increase by the inflation rate over the long-term, you probably want to re-evaluate if buying a home is really the best use of your hard-earned money.

Homeownership can provide all kinds of nonfinancial payoffs towards a more fulfilling life but the best use of your money going forward is definitely worth exploring further. Are the costs of homeownership still worth it without explosive price increases or would you be better off renting a home and investing your nest egg in the stock market?